Over the last two decades, shipping has gradually lost its image as a green mode of transport following the emergence of regulatory initiatives that cover emissions from other transport modes. It was left out of the Kyoto Protocol and the subsequent Paris Agreement due to industry insistence that the global regulation of shipping should be done by the International Maritime Organisation (IMO), and since the 1990s, IMOs environmental record has been less than optimal (Hackmann, 2012: 90; InfluenceMap, 2017: 6). This has led some scholars of International Political Economy to question whether IMO is suited to regulate the complex shipping industry, and scholarly attention has shifted to the emergence of private governance initiatives aimed at greening international shipping, usually with a focus on greenhouse gas (GHG) emissions.

Contrary to the dominant narrative of corporate capture at the IMO, the organisation has recently succeeded in developing stringent regulation of sulphur (SOx) emissions. This research project has adopted a neo-pluralist framework of analysis and has investigated the role that conflict between business actors has played in IMO’s decision in 2008 to tighten the global cap on sulphur emissions from 4.5% m/m to 0.5% m/m by 2020, informally known as “IMO 2020”. The main finding is that corporate actors did not form a monolithic bloc in opposition to environmental regulation, as perhaps expected by adherents of structuralism, and that one corporate actor in particular – INTERTANKO – took on the role as regulatory entrepreneur and pushed for stringent caps. The societal context of the negotiations, particularly the regulatory pressure IMO was subjected to given the fact that equivalent emissions from land-based sources had already been regulated and some member states were threatening unilateral action, appears to have played a central role in propelling the INTERTANKO proposal forward.

The literature review will discuss the structuralist and neo-pluralist understandings of the role of corporate actors in global environmental governance, and will then provide a brief overview of the existing literature on the environmental governance of shipping. The methods section will introduce the method of archival research which has been adopted, and the thematic analysis used. A background section will then briefly explain the processes of environmental policy-making at IMO and the extent of corporate access here, and it will also provide an introduction to MARPOL Annex VI, the regulatory instrument which covers sulphur emissions.

The first findings section will discuss the policy preferences of various industry associations in relation to the proposed tightening of the existing sulphur cap, highlighting the early fragmentation of policy preferences among shipping actors when INTERTANKO broke out of a unified shipping coalition. The second findings section will discuss the strategies adopted by these actors, including the arguments and evidence they mobilised to support their preferred policy outcome, and how these strategies shifted once it became clear that regulation was inevitable. The third findings section will discuss the extent to which these strategies were influential in shaping the final policy outcome, arguing that the stringent INTERTANKO proposal became highly influential partly because IMO was under great pressure to prove its ability to act as the legitimate regulator of global shipping emissions. The discussion section will address implications for structuralist and neo-pluralist approaches to understanding the role of corporate actors in global environmental governance, and the findings’ implications for the role of IMO as a regulator of shipping’s environmental impact. The conclusion will summarise the findings and arguments, establishing support for the neo-pluralist framework and concluding that the ability of IMO to regulate shipping must be evaluated in the context of each specific issue area, and the interests that prevail here.

Literature Review

Corporate Actors in Environmental Governance

Scholars of International Political Economy (IPE) have increasingly challenged the inability of traditional regime theory, with its focus on the state as the unit of analysis, to account for the role of corporate actors in processes of international regulation, defined by Walter Mattli and Ngaire Woods as “the organisation and control of economic, political, and social activities by means of making, implementing, monitoring and enforcing rules” (2009: 1). For analytical purposes, Kenneth Abbott and Duncan Snidal have divided the regulatory process into five stages: agenda-setting, negotiation, implementation, monitoring, and enforcement (2009). Doris Fuchs is among the scholars arguing that there has been a scarcity of systematic research on the role and power of business in global governance (2007: 2), and her concern is mirrored and addressed by Robert Falkner (2008), David Levy and Peter Newell (2005), and Christopher May (2006).

The disciplinary shift to incorporate the role of corporations and civil society actors is perceived to be a response to economic globalisation since the 1980s (Fuchs, 2007: 2), where “the scale and structure of global production” now challenges states’ ability to regulate economic activity (Abbott and Snidal, 2009: 44). In broad terms, there are three main approaches to understanding corporate power: the pluralist, structuralist, and neo-pluralist approaches. The pluralist approach, which understands business actors to operate as any other interest group in society on the basis that sectoral conflict prevents them from acting in a uniform way (Levy and Egan, 1998: 341), will not be addressed here since there is broad agreement today that corporations represent economically privileged interest groups.

The structuralist approach assumes that the structure of the global economy provides business with a unique power to influence policy-making. Susan Strange is a central figure in the structuralist scholarship, and in the book Rival States, Rival Firms which she published with John Stopford and John Henley, they argue that as a result of economic globalisation and the ability of firms to move capital to other jurisdictions, “firms have become more involved with governments and governments have come to recognise their increased dependence on the scarce resources controlled by firms” (Stopford, Strange and Henley, 1991: 14). Proponents argue that corporations’ role as “the primary source of growth, employment and innovation in capitalist societies” puts them in a position to keep certain issues off the regulatory agenda in order for states to keep reaping the benefits they provide (Vormedal, 2017: 48). This control of the regulatory agenda is known as regulatory capture – “the control of the regulatory process by those whom it is supposed to regulate or by a narrow subset of those affected by regulation, with the consequence that regulatory outcomes favour the narrow ‘few’ at the expense of society as a whole” (Mattli and Woods, 2009: 12). A key structuralist assumption is that globalisation will likely result in a regulatory race to the bottom, or to ineffective and overly market-friendly regulatory options, since states have to compete to attract business (Vormedal, 2017: 48).

The structuralist approach appears to have some explanatory power. David Levy and Daniel Egan (1998) highlight that the Byrd-Hagel resolution, mandating the rejection of the Kyoto Protocol on the basis that it would threaten American jobs and firms’ international competitiveness, was unanimously approved by the US senate in 1997, thus making the United States a laggard in the climate change negotiations (1998: 347). Industry actors have also circumvented the states system altogether by developing voluntary codes of conduct, such as the ISO 14 000 standards, partly with the aim to “prevent, or at least soften, present and future state-determined environmental regulations” (Clapp, 1998: 295). This proliferation of private environmental governance initiatives marks a significant shift in the global governance architecture and could signify either an inability or an unwillingness among states to regulate these global issues. The effectiveness of private governance initiatives has been disputed by scholars in the field, who have argued that many of the emerging private governance networks have relatively few members, often from the developed world, and that they generally lack effective compliance mechanisms (Auld and Guldbrandsen, 2016: 402).

The neo-pluralist approach to global environmental governance has emerged as an attempt to explain the cases where international environmental regulation appears to have been successful despite the structural power of business. The core argument of neo-pluralism is that corporate actors are in a privileged position, but that its power must be studied in the context of a particular issue area, as historical factors such as conflict between different industry groups have the power to reduce the influence of business relative to other groups (Falkner, 2008: 17). A neo-pluralist analysis holds that it cannot be assumed a priori that business involvement results in regulatory capture.

Robert Falkner distinguishes between three aspects of business power: relational, structural and discursive (2008: 27-32). The relational aspect pertains to financial, organisational and institutional resources that give business influence in negotiations, such the ability to buy scientific expertise and their ability to join forces across borders and lobby relevant actors as a unitary interest group (ibid.: 27-28). The structural aspect pertains to (a) constraints put on policy-makers by the need to avoid undue burdens on economic sectors, as this may harm the industry’s competitiveness, causing businesses to consider relocating and thus possibly harming the national economy, and; (b) the dependence of policy-makers on businesses’ technological knowledge, which might allow businesses to influence the phasing of regulations (ibid.: 30). The discursive aspect pertains to the ability to control ideas, such as defining the nature of the problem and deciding which policy options are technologically and economically feasible (ibid.: 31-32).

Falkner argues that corporate preferences and strategies are a function of both economic and institutional factors specific to the firm, and that conflict or unity between actors might emerge on the basis of these factors (2008: 35). Economic factors relate to the firm or industry’s position in the global market in relation to competitors. For example, conflict over desired policy outcomes might emerge between national and international firms, firms of different technological capacity, and firms that are located in different parts of the same supply chain (ibid.), since the cost of a particular regulatory outcome will affect these groups in different ways. Additionally, Falkner argues that the social aspects of preference formation must be accounted for, as recognised by sociological and institutionalist theories of the firm (ibid. 36). For example, the home country of a multinational corporation could influence its values and which interests are perceived as legitimate, and might therefore shape its strategy. Once preferences are determined, corporate influence depends on firms’ ability to build alliances and mobilise the different aspects of power discussed above.

Jonas Meckling has created a typological model that adopts these economic and institutional determinants of corporate preference and uses them to predict corporate strategy towards environmental regulation. He argues that the combination of distributional effects and regulatory pressure on the firm or industry will result in the adoption of one of four broad strategies towards regulatory action: opposition (attempting to veto an initiative), hedging (seeking to minimize compliance costs or level them globally), support (aiming to create or expand markets) and non-participation (2015: 19-20). Meckling defines distributional effects as “when environmental regulation causes lower aggregate costs for some industries than for others; when it generates rents for some industries or firms while erecting barriers for other industries and firms; and when it causes different costs for firms in the same industry” (ibid.: 20). The organisational field is defined as “a collection of contextual factors or conditions affecting organisation structures or processes” (Scott cited in Meckling, 2015: 20). This field includes the norms of the home and host countries, pressure from environmental NGOs and wider civil society, and other social factors that put pressure on a firm’s preferences. The hedging strategy can, according to Meckling’s model, result in a race to the top in regulation, instead of a race to the bottom, which is often structuralism’s predicted outcome of corporate influence.

Irja Vormedal has expanded this framework by emphasising the importance of shifts in industry strategies and preferences over time (2010). She argues that certain events, such as the introduction of concrete regulatory proposals, are likely to cause industry groups to change their strategy from opposition to pro-regulatory hedging in favour of an outcome with low compliance costs (ibid.: 255). In the process, it might become more challenging for business actors to maintain their unity given the distributional effects of a proposed policy, and segments of industry that stand to gain in relative terms, or that face strong regulatory pressure, may push for stricter regulation. According to her “tipping point” model, this gradual fragmentation in industry position is likely to result in an agreement, since regulatory laggards no longer dare to take the risk of opposition once the issue has reached a particular salience point (ibid.: 256). Walter Mattli and Ngaire Woods’ concept of a “corporate entrepreneur” is useful here, which refers to firms and industry groups that could have a positive impact on regulation because they have an incentive to push for regulatory change (2009: 32).

The Environmental Governance of Shipping

The shipping industry has come under a lot of scrutiny in recent years over its failure to regulate greenhouse gas (GHG) emissions at a time when emissions from land-based sources have increasingly been regulated through international agreements such as the Kyoto Protocol and the European Union’s Emission Trading Scheme (EU ETS). Despite the fact that shipping has been progressively losing its image as a “green” mode of transport, scholars that have studied the environmental governance of shipping have remarked that research on this particular industry is scarce compared to industries like agriculture, forestry, fisheries and manufacturing (see Lister, Poulsen and Ponte, 2015: 186).

In the literature on the environmental governance of shipping, a shared understanding appears to have emerged that the International Maritime Organisation (IMO) – the sole international authority for regulating shipping emissions – has failed to develop effective regulations to protect the marine environment in recent decades. The arguments put forward are largely based on structuralist assumptions and have an unfortunate tendency to view all issue areas together, often by extrapolating from IMO’s record of regulating GHG emissions. Lister, Poulsen and Ponte argue that since the 1990s, “with the exception of oil spills, regulatory development has stalled with respect to all of the major issue areas including CO2 and other emissions, and invasive species” (2015: 187). Michael Roe argues along structuralist lines that hierarchical state-based governance of shipping is failing due to the forces of globalisation, and that IMO is “no longer fit for the task as they reflect a national domination of jurisdictional integrity that is inappropriate for an increasingly global shipping industry” (2013: 170-171).

One notable exception is Md Karim, who argues that IMO “has not only promoted the adoption of numerous international marine environmental legal instruments, but also gradually established well-functioning institutional structures for marine environmental protection”, and that “[m]any of the organisation’s shortcomings are not due to any deficiency in the work process of the organisation; they are related to broad international politics underpinning relations between States” (2015: 152-153). Whereas Roe argues that states have lost the power to regulate as a consequence of globalisation, Karim argues that states have a choice in whether or not to regulate, but that for political reasons they sometimes choose not to. This distinction is important, because Karim’s position retains the agency of states and establishes that regulation is usually an issue of political will, not necessarily of ability.

The assumption in the main body of literature that IMO is unable to govern has led to a proliferation of studies on emerging private governance initiatives in shipping. Wuisan, Leeuwen and Koppen have evaluated the Clean Shipping Project (a public-private partnership), and found that its ability to set ambitious emission targets within a short timeframe compared to IMO is a key strength, but that it suffers from weaknesses including lack of commitment within the network, lack of resources, lack of compliance mechanisms and accountability, and the fact that it has to compete with other private initiatives (2012: 172). Yliskylä-Peuralahti and Gritsenko suggest that “maritime governance can be made more effective by mixing public and private as well as mandatory and voluntary forms of regulation” (2014: 253). Similarly, Lister, Poulsen and Ponte argues that the proliferation and fragmentation of governance initiatives is a barrier to effective governance, and that the possibility for IMO to orchestrate these initiatives – to provide legitimacy and coordination – should be investigated (2015: 193).

These studies all identify the ineffectiveness of private initiatives, and it is puzzling that the assumption of regulatory capture at IMO, justified by the observation that the organisation has failed to regulate environmental issues since the 1990s, is not expected to prevail in the arena of private governance. Mandating IMO to orchestrate these private initiatives will simply bring them into the same regulatory arena which, according to these studies, has failed to effectively govern the environmental impacts of shipping in recent years. The studies appear to have accepted the structuralist assumption that globalisation has somehow made shipping ungovernable, despite the fact that this industry has been “global” and elusive for a much longer period than since the 1980s. The structural power of a somewhat monolithic “business” is assumed a priori, which unfortunately precludes a more nuanced, historical analysis of the constellation of interests and power dynamics that determine whether regulation (public or private) can be successful – a central focus of neo-pluralist scholarship.

Sulphur (SOx) regulation at IMO

The case of sulphur oxide (SOx) regulation at IMO (with the recent regulatory changes known informally as “IMO 2020”) does not fit the narrative that IMO has failed to regulate environmental issues since the 1990s. In 1997, IMO’s Marine Environment Protection Committee (MEPC) agreed to a 4.5% m/m global cap on sulphur emissions as part of the newly created Annex VI to the International Convention for the Prevention of Pollution from Ships (MARPOL). Alan Khee-Jin Tan argues that “owing to the powerful objections of the oil industry as well as the oil-producing and -refining states, a more stringent cap [than 4.5 percent] could not be obtained” (2006: 160), thus resulting in a geographically differentiated regulatory scheme where stricter emission caps were adopted only in sulphur emission control areas (SECAs). In 1997, the corporate capture argument appears to be valid, as the average sulphur content in ships worldwide was between 2.8 and 3.5 percent at the time, making the global cap redundant (ibid.: 159).

In 2008, however, MEPC agreed to reduce the global cap on sulphur emissions from 4.5% m/m to 0.5%, despite the fact that the average sulphur content of fuel was still 2.42% in 2007, not controlling for SECAs (Secretariat, 2008: 1). Lister, Poulsen and Ponte’s argument that IMO has failed as an environmental regulator since the 1990s therefore appears to be an inaccurate generalisation. They briefly address the issue of tightening the SOx regulations, but by observing that the 0.5% global cap will be costly, and that the cap is still much higher (and comes much later) than equivalents from land-based sources like cars (2015: 188-189), they dismiss the SOx reduction case without further analysis. When compared to the significant weaknesses of private initiatives, this decision is odd, and has the political consequence of delegitimising IMO (and the inter-state regulatory system) as a regulator of shipping instead of recognising and investigating instances where it appears to succeed.

To date, studies have been conducted on the economic consequences of the 0.5% cap and possible technical means of compliance (see e.g. Halff, 2017; Hilmola, 2015) as well as on the likelihood of compliance (Bloor et al., 2015), but no studies have researched the regulatory process leading to the stringent cap, including the preferences and strategies pursued by various corporate actors, and which ones were ultimately influential. This study aims to fill this gap by investigating the policy process that resulted in the 0.5% global cap on sulphur emissions from shipping agreed in 2008.

Method

This study aims to investigate the role that business conflict played in the International Maritime Organisation’s decision to tighten the global cap on sulphur emissions in 2008. Building on the neo-pluralist framework, it aims to investigate the following in particular: (a) the policy preferences of corporate actors, and whether they were fragmented or monolithic; (b) strategies they pursued to achieve their desired policy outcomes, and; (c) the extent to which these strategies were successful in influencing the final policy outcome.

The sample consists of 166 archival documents from the International Maritime Organisation, including position papers from states, environmental NGOs and industry groups, as well as Secretariat reports on the discussions and outcome of meetings. These documents were identified by conducting an archival search on the keywords “sulphur” and “SOx” in IMO’s online public archive called “IMODOCS”, as well as by tracing and identifying all documents from the relevant agenda items over the period 2005-2008. Intersessional meeting documents are not available in the IMODOCS archive but were accessed through the websites of the Swedish Transport Agency. The use of archival data makes it possible to trace corporate influence by looking at whether policy proposals are supported and adopted by other actors over time, ultimately making it into policy.

The documents have been analysed on the basis of three themes: policy preference, strategy, and influence. For all three themes, the analysis has also included attention to changes over time, as Vormedal expects corporate preferences and strategies to change throughout the policy process (2010). Meckling’s typological model (opposition, support, hedging and non-participation) has been adopted as a guiding framework for identifying corporate preferences (2015). Preferences and strategies are tightly linked, but for purposes of analysis, they will be treated separately. This allows for a more detailed investigation into the possible causes of policy preferences (distributional effects of regulation and the varying regulatory pressure exacted on different industrial sectors), often explicitly stated in the position papers, which ultimately lead to differences in strategy. The identification of corporate strategy (the ways in which corporate actors try to win support for their preferred policy outcome) has been guided by Falkner’s relational, structural and discursive aspects of business power discussed above (2008: 27-32). Finally, corporate influence has been identified by looking at whether an argument or a regulatory proposal gains support from other actors and is picked up in the discussion over time, and to what extent it is reflected in the final policy.

Background

Policy-making at the IMO

The International Maritime Organisation is a United Nations agency responsible for shipping activities, including shipping’s effect on the marine environment. The IMO Convention of 1948 allows for three groups of actors to participate in its law-making processes: member states, inter-governmental organisations as observers (e.g. the European Commission), and international NGOs as organisations with consultative status (Karim, 2015: 16). The groups with consultative status are not allowed to vote but may still exert influence through document submissions and discussions at various sessions. 81 NGOs have been granted consultative status (IMO, n.d.a), including environmental NGOs (ENGOs, e.g. Friends of the Earth International (FOEI)), ship-owner associations such as the International Chamber of Shipping (ICS) and representatives of oil companies including the Oil Companies International Marine Forum (OCIMF).

The IMO organisational hierarchy consists of the Assembly (all members), the Council (40 members elected by the Assembly on a quota system), five Committees (where the Marine Environment Protection Committee (MEPC) is of particular relevance to this study), and seven sub-committees to assist MEPC and the Marine Safety Committee, as well as the Secretariat (Karim, 2015: 21-28). MEPC was established in 1973 and is responsible for IMO’s work on legal instruments related to the prevention of marine pollution. When environmental regulations are adopted or amended, this happens in MEPC (ibid.: 25). MEPC frequently delegates work to inter-sessional working groups and scientific expert groups in order to deal with its increasingly growing workload, and the conclusions of these groups are then subsequently discussed in the regular MEPC sessions (ibid.: 26).

In the 1970s, IMO introduced the rule of “tacit acceptance”, which means that an amendment to a technical annex will automatically come into force after a certain period, unless the amendment is opposed by a certain number of member states within that period (Karim, 2015: 36). This rule means that the organisation avoids the problem that certain amendments do not come into effect because they lack ratification by enough parties. This principle is important for the tightening of the sulphur cap because it puts pressure on affected parties to reach an acceptable policy outcome, since the amendment will be automatically adopted by parties to MARPOL Annex VI.

Marpol Annex VI

The International Convention for the Prevention of Pollution from Ships (MARPOL) was adopted in 1973, following a series of tanker accidents and in response to growing ecological consciousness in the United States in particular (Tan, 2006: 129). It is the main international convention that addresses pollution from ships, whether through accident or normal operation. The 1973 Convention was absorbed by the 1978 MARPOL Protocol, and on 2 October 1988, the combined instrument entered into force (IMO, n.d.b).

In 1997, MARPOL was amended to adopt Annex VI on the prevention of air pollution from ships, and this amendment entered into force 19 May 2005. This annex is designed to cap emissions of SOx, NOx and particulate matter, and was recently expanded to cover GHG emissions (ibid.). The issue of sulphur emissions from ships was first raised by Norway at the Second International Conference on the Protection of the North Sea in 1987, following a period where acid rain had become a concern in Europe and North America, and the discussions at this conference led to the issue being raised at IMO (Tan, 2006: 155-6).

In 1997, a broad agreement existed that a fuel standard with a sulphur “cap” was the best solution. However, while the concerned states and the environmental organisations wanted a much stricter cap than the global standard for marine fuel prescribed by the International Organisation for Standardisation (ISO) (a maximum sulphur content of 5 percent), a strict global cap was unacceptable to oil-producing countries where the crude oil contained high levels of sulphur (such as the Persian Gulf), as well as for ship-owners, who would face an increased cost of bunker fuels (Tan, 2006: 156-7). Shipping is one of very few remaining markets for “bottom of the barrel” oil products, so losing this market would be damaging to the oil industry (ibid.: 159). What emerged was a geographically differentiated system where stricter caps of 1.5 percent would exist within special sulphur emission control areas (SECAs), and the global cap was placed at a lenient at 4.5 percent (ibid.: 158, 160).

In October 2008, MEPC 70 adopted an amendment to MARPOL Annex VI that would reduce the global sulphur cap to 0.5% on 1 January 2020, including an interim cap of 3.5% globally from 1 January 2012. The SECA caps were also tightened. Following a fuel availability study, the 2020 date was fixed by the member states in 2016 (IMO, n.d.c: 2). In addition to low-sulphur fuel, ships may use exhaust gas cleaning systems (“scrubbers”) to comply with the new caps (ibid.). This reduction is significant, since MEPC reported the average sulphur content of residual fuel in 2007 to be 2.42%, not controlling for the entering into force of SECAs, where emission limits have been 1.5% since 2005 (Secretariat, 2008a: 1).

Findings

Preferences

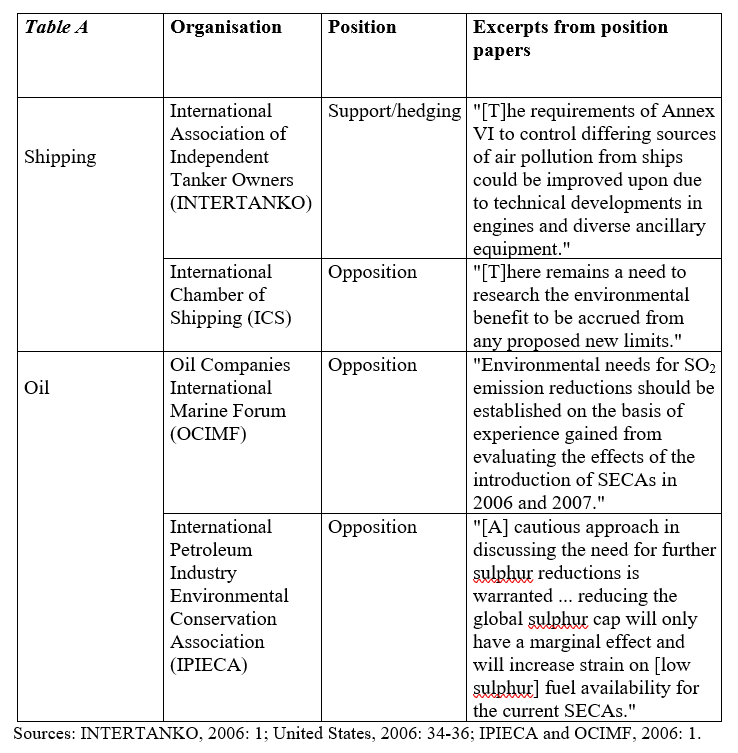

The proposal to start a process of revising MARPOL Annex VI was made by a member state coalition consisting of Finland, Germany, the Netherlands, Norway, Sweden and the United Kingdom at the Marine Environment Protection Committee’s 53rd session in April 2005 (Finland et al., 2005). A review of the Annex was not due until five years after it entered into force on 19 May 2005, but the sponsors of the document argued that on the basis of technological availability and the consequences on human health, the Committee should expedite the review process and look into the possibility for reducing the global cap on sulphur emissions (regulation 14) as well as a potential review of the limits on nitrogen oxide (NOx) and particulate matter (PM) (ibid.: 2-3). A general review of Annex VI was approved by the Committee (Secretariat, 2005: 33). The industry response to the reform proposal appeared to reflect a unitary position of reluctance to regulate (opposition) at the first meeting to address the revisions (the 10th session of the Sub-Committee on Bulk Liquids and Gases (BLG) in April, 2006), but by the time of its inter-sessional working group on air pollution in November, policy preferences were fragmenting. At the first meeting, the International Association of Independent Tanker Owners (INTERTANKO) co-sponsored a submission with the International Chamber of Shipping (ICS), the Baltic and International Maritime Council (BIMCO), The International Association of Dry Cargo Shipowners (INTERCARGO) and the International Council of Cruise Liners (ICCL) in which they strongly emphasised that “there is a need to verify, to the extent possible, the environmental needs to make MARPOL Annex VI provisions more stringent”, and congratulated Norway on its submission which proposed no reduction of the global sulphur cap (ICS et al., 2006: 1-2; Norway, 2005: 7). However, by the time of the inter-sessional meeting in November, INTERTANKO had changed its position and started promoting a reduction of the global sulphur cap to 0.5% by 2015, as well as a mandate that this reduction should be made by a low-sulphur fuel requirement, and not by emission abatement alternatives such as the use of scrubbers (INTERTANKO, 2006: 5). See table A for an overview of various industry positions at this time.

The oil industry’s united opposition to tightening the sulphur cap is not surprising. Any regulatory tightening of the sulphur cap will impose great costs on the refining industry as a whole, by forcing them to invest in upgrading their refineries in order to produce more low-sulphur fuel, by losing one of their only markets for bottom-of-the-barrel heavy fuel oil, and by risking a shipping industry shift away from traditional modes of fuel and onto alternative fuels such as liquefied natural gas (LNG) (Tan, 2006: 159-161; IPIECA and OCIMF, 2006: 2). Conflict might be present between large refineries and smaller refineries who may not be able to upgrade (and do not have a voice at IMO), and between refineries of naturally high-sulphur oil (e.g. the Persian Gulf) and refineries of oil with naturally lower levels of sulphur (North Sea states) (Tan, 2006: 157). However, since all major refineries will face the prospect of relatively high compliance costs, unified opposition at IMO is to be expected. During the original Annex VI negotiations in 1997, the oil industry and refining states strongly opposed a global cap, and proposed a lenient 5% global cap (the ISO standard at the time) with stricter caps only in very restricted SECAs (Tan, 2006: 159-161). With a slight concession (down to 4.5% globally) this is what ultimately ended up as the original agreement.

The observed fragmentation of preferences in the shipping industry is also expected, as the distributional effects of MARPOL Annex VI on shipping are more uneven than its effects on oil. In the short term, the shipping industry will face higher compliance costs in absolute terms, since an increase in the demand for low-sulphur bunker fuels will cause a price increase also affecting actors already using this fuel and therefore likely conforming to a new sulphur cap. With shipping, however, several factors play a role. Segments of the shipping industry might want to level the global regulatory playing field that is currently uneven as a consequence of SECAs, at the same time as they do not want to increase the price of bunker fuel. Shipping firms that operate in the North Sea region struggle with fuel changeovers every time they enter and leave the SECA and therefore have a greater incentive to level these different regulatory areas. Norwegian tanker owners form a significant proportion of the INTERTANKO membership, and presuming that a number of these ships operate in the North Sea, it is not surprising that INTERTANKO is interested in getting rid of SECAs by lowering the global cap (Tan, 2006: 38). The issue of uneven playing fields has historically been a concern for the whole industry. ICS voiced their concerns about the special area concept during the original negotiations because they feared market distortion (ibid.: 158).

Shipping firms and associations might also be subject to greater environmental pressure than oil firms are. Ships operate higher up in the supply chain and face greater pressure from charterers and retailers to clean up their operations, as indicated by the emerging private environmental governance initiatives such as the Clean Shipping Project (see e.g. Wuisan, Leeuwen and Koppen, 2012). INTERTANKO’s decision to push for tighter regulation does seem to be influenced by economic factors, as they aim to create “a global sulphur emission control area” to avoid fuel changeovers when entering a SECA (INTERTANKO, 2006: 2). However, the tanker industry has historically been subject to harsh environmental criticism, and IMO’s environmental projects only really took off after a series of tanker accidents which resulted in the development of MARPOL in 1973 (IMO, n.d.b). Additionally, INTERTANKO is headquartered in Norway, the country that initially proposed the global sulphur cap in response to acid rain (Tan, 2006: 155). While it seems likely that its home country has influenced INTERTANKO’s position, it is difficult to disentangle economic interest (levelling the economic playing field and avoiding fuel changeovers) from normative pressure to be environmentally friendly (tankers’ poor track record and Norway’s environmental preferences).

This section has established that corporate actors did not form a monolithic bloc in opposition to the proposed tightening of the sulphur cap. The oil industry was uniformly opposed to change, but the shipping industry differed in their positions. Whereas ICS adopted a cautious approach to proposed reductions, referring to the need to establish the environmental impacts of existing regulation, INTERTANKO proposed to reduce the global sulphur cap to 0.5% by 2015. A desire to level the regulatory playing field is likely to be a factor, but this position might also have been shaped by the fact that the tanker industry has come under particularly harsh environmental scrutiny following its history of accidents and oil spills, and the fact that INTERTANKO is based in Norway, which is the member state that initially proposed the global sulphur cap. The oil industry is more hidden from public scrutiny as it is located further down the production chain, and it has fewer alternatives to comply with a new regulation than the shipping industry does.

Strategies

During the negotiations, INTERTANKO took on the proactive role of regulatory entrepreneur, and was the first industry actor to present a concrete proposal for amendments to MARPOL Annex VI. The proposal included a significant reduction in the global cap (from 4.5% to 0.5%) and a removal of the differentiated SECAs (see INTERTANKO, 2006). In addition, INTERTANKO requested a technical requirement that all ships should have to use low-sulphur fuel oil (LSFO) by 2015 (ibid.: 2). Their core selling point was that this amendment would improve “compliance, enforcement and monitoring” due to consistency in standards and requirements (ibid.: 1). A clear, uniform cap would produce “a long term and positive reduction of air emissions from ships” as well as “contribute to a long term and predictable regulatory regime” (ibid.). It would simplify ship operations by avoiding a complex compliance regime and potentially dangerous fuel changeovers and would have the added benefit of not requiring additional emission reduction technology for particulate matter, as particulate matter is generally a product of high-sulphur fuel oil (ibid.: 4-9).

Even though there were minor differences in the preferred policy outcomes of ICS, BIMCO and the oil industry, they adopted a reactionary approach to the negotiations aimed to delay and water out the outcome. The arguments they put forward can be grouped into three broad categories: (a) lack of knowledge/sound science; (b) net environmental benefit, and; (c) availability of fuel and technology, including matters of cost efficiency and market disruptions.

The importance of having enough information was an issue that the oil industry raised throughout the entire negotiation process. In the early stages of the negotiations, the focus of the arguments was on the fact that “Annex VI has only recently entered into force and the improvements generated have yet to be measured” (ICS, 2006: 1). Similarly, OCIMF and IPIECA argued that any reduction in the sulphur caps should only occur “on the basis of clear and well-documented compelling need” (IPIECA and OCIMF, 2006b: 1). However, following the working group meeting where the INTERTANKO proposal was first discussed (BLG WGAP-1), OCIMF still argued that “the BLG-WGAP 1 did not establish the need for a change in the annex”, and that the committee must “address this concern”, instead of coming up with a preferred regulatory pathway (OCIMF, 2007: 1-2).

The oppositional actors did not, however, accept scientific evidence that did not align with their preferred policy outcome. When information was presented by Friends of the Earth International on the serious health consequences of SOx emissions (FOEI, 2007a), IPIECA and OCIMF submitted a document in which they challenged the methodology of the study, and argued that it “creates an incorrect impression of the health benefits that may be expected from global shipping emission reductions” (IPIECA and OCIMF, 2007: 1). This scientific tug-of-war was present throughout the negotiation process, where actors on all sides tried to prove that “science” (whether environmental, medical or technical) was on their side.

Another common strategy was to adopt the language of environmentalism by arguing for regulatory approaches that take the “net environmental benefit” into account. In practice this meant questioning the effect of SOx regulations rather than proposing solutions to its environmental side effects. IPIECA and OCIMF submitted a report to BLG-WGAP 1, developed by the Oil Companies’ European Association for Environment, Health and Safety in Refining and Distribution (CONCAWE) which found that “large scale residue desulphurisation or conversion of residue to distillate fuel will significantly increase global refinery CO2 emissions (IPIECA and OCIMF, 2006c: 1). This report was developed in criticism of INTERTANKO’s request to make distillate fuels compulsory.

INTERTANKO challenged this criticism by pointing out that scrubbers, the main alternative to using distillate fuels, “would still generate solid and liquid waste and would discharge millions of tonnes of sulphur into the sea instead of into the air”, and that “sulphur reacts with sea water and, as a result of chemical reactions there is a significant release of CO2“, arguing that refineries are better equipped than ships to process the unwanted elements (INTERTANKO, 2007: 2-4). The INTERTANKO position received support from FOEI, which disagreed strongly with the adoption of environmentalist language for the purpose of watering out stringent requirements, and suggested that “any holistic approach to this issue must include the effects of [heavy fuel oil] on marine life” (FOEI, 2007b: 1). In this instance, a business NGO (INTERTANKO) allied with an environmental NGO (FOEI) to push for regulation, clearly illustrating fragmentation in business preference and strategy, and cross-sectoral alliances on the basis of policy preference.

The final group of arguments related to cost efficiency, the availability of fuel and technology, and the potential for disrupting markets. In the early document that INTERTANKO submitted with ICS, BIMCO and others, they argued that “technology to meet increasingly stringent emission limits is still at the design stage or at best in its infancy in some areas and prototype units will require further testing and development before becoming commercially available” (ICS et al., 2006: 2). After the INTERTANKO proposal, the arguments shifted towards the potentially catastrophic impact of a global distillate fuel requirement. ICS argued that “there would be unclear and ill-defined impacts of adopting a sweeping requirement for low-sulphur distillate fuels”, and that “[t]his may have major effects on ship propulsion modes, intermodal transport balances, refining capacity and supply, generation of greenhouse gases and perhaps even the global balance of trade” (ICS, 2007: 2). IPIECA argued that the INTERTANKO proposal “would have major repercussions on the global refining industry and on fuel and energy markets beyond the marine fuel market (IPIECA, 2007a: 4), and that “[e]xperience has shown that large volumes of low-sulphur residual marine fuel cannot reliably be produced at sulphur contents below 1% due to technical, quality, and economic constraints” (IPIECA 2007b: 2).

Once again INTERTANKO challenged the arguments of the oil industry and ICS. It argued that “availability is an issue for either alternative solution, low sulphur fuels and scrubbers” but that “marine distillate fuels is a product already available”, and “if low sulphur marine distillate is mandated by IMO, it would generate a safe and stable demand with refineries able to get a safe return on their investment” (INTERTANKO, 2007: 2-3). The seemingly technical issue of whether or not the market could handle stricter regulation was therefore politically disputed and open to speculation. In other words, the structural aspects of business power (technical constraints and the limits imposed by the needs of the market) became an issue of discursive contestation between different strands of business, which served to weaken the power of the oppositional business actors to effectively oppose (or “capture”) regulation, at least at the negotiation stage of the regulatory process.

The strategies of the corporate actors sceptical of regulation shifted from outright opposition in the early stages of the negotiations, to a strong request for performance requirements (abatement technology allowed) over technological requirements (only distillate/low sulphur fuel allowed) as the negotiations went on. Soon after the INTERTANKO proposal, ICS requested “a goal-based approach to emission reduction whereby emission limits should be set according to environmental need thus leaving the market and technology to find the appropriate solutions” (ICS, 2007: 2). Similarly, OCIMF argued that the final regulation “must be goals-based, providing flexibility to the different sections of industry regarding the means of achieving the agreed objectives” (OCIMF, 2008: 2). BIMCO argued that a shift to distillate fuels overnight “will most likely create a very chaotic situation in the bunker market and will force Flag States and Port States to issue waivers right, left and centre in order to keep world trade moving”, arguing that “[the INTERTANKO proposal] will not deliver until 2020 at the earliest” (BIMCO, 2008: 3, 4).

This is in line with Vormedal’s expectations that industry strategies will shift from outright opposition to a “hedging” strategy once a detailed proposal is on the table (Vormedal, 2010: 256). Interestingly, after the final agreement was adopted and the 2020 deadline was fixed by MEPC, the shipping industry once again united in order to push for a global ban on the carriage of high-sulphur fuel oil on ships that have not installed scrubbers, in order to make the cap easier to enforce and avoid certain firms gaining a competitive advantage through non-compliance (ICS et al., 2017). It is therefore possible for an industry group that was initially very hostile to regulation to become a supporter of stringent enforcement mechanisms once regulation becomes inevitable.

This section has identified INTERTANKO as a regulatory entrepreneur with a proactive strategy. INTERTANKO proposed a concrete global cap with a specific deadline (0.5% sulphur cap by 2015), with a request for a technical (fuel) requirement. The oil industry and segments of the shipping industry, on the other hand, adopted a reactionary strategy aimed at delaying and watering out the final agreement. They mobilised arguments based on a need for evidence and sound science, a need to take net environmental benefit (CO2 emissions) into account, and economic concerns related to availability of technology and the possibility for market disruptions to support their policy preferences. The strategies of the opposing corporate actors shifted from one of outright opposition to one of pushing for performance requirements and longer compliance deadlines once the INTERTANKO proposal became subject to serious discussion. Once the cap was agreed, the shipping industry once again united to push for measures that would simplify enforcement.

Influence

The institutional access provided to corporate actors by the IMO gives them a degree of influence on negotiations which is not granted by other UN agencies. A report by InfluenceMap finds that IMO is the only agency that permits corporate actors as part of state delegations, and is one of only three agencies (the other two being the Food and Agriculture Organisation and the World Health Organisation) which allow official corporate representation at committee meetings (InfluenceMap, 2017: 18). For example, the Marshall Islands, with the third largest shipping fleet in the world, is partly represented at IMO by International Registries Inc. (a US private shipping registry), and its state representatives have at times come into conflict with representatives from International Registries over the country’s position in negotiations (ibid.: 16). Furthermore, a report by Transparency International found that trade associations had nearly five times more representatives at IMO than civil society organisations such as ENGOs (312 to 64) (Transparency International, 2018: 2) The corporate actors with consultative status are all business associations (see IMO, n.d.a), so large firms will therefore be better represented at IMO than smaller firms.

INTERTANKO’s proactive approach turned out to be highly influential in the negotiations, as its proposal became a turning point and subsequently the centre of discussion throughout the entire negotiation process. This is evidenced by member states shifting their positions and voicing their support for the INTERTANKO proposal in their position papers. The group of corporate laggards could initially claim legitimacy by explicitly aligning themselves with Norway, perceived to be an environmental leader given its role as the original proposer of a sulphur cap. At the beginning of the negotiations, Norway argued that a reduction of the global cap was unnecessary, and that the focus should be on implementing SECAs instead (Norway, 2005: 7; ICS et al., 2006: 2).

Following the INTERTANKO proposal, Norway amended its position and argued that “the proposal by INTERTANKO and the discussions at BLG WGAP-1 in Oslo have initiated a revision of our viewpoint” and that “Norway therefore fully supports the proposal to use distillate fuels only with a global cap of 0.5% m/m sulphur for all ships by 2015” (Norway, 2007: 2). Sweden argued that it “finds a lot of merit in the INTERTANKO proposal”, and that it “contains many advantages and should be given further qualified consideration” (Sweden, 2007: 1). The United States argued that “the use of distillate fuel will provide significant public health and welfare benefits, and the proposal from INTERTANKO should be evaluated by the Sub-Committee” (United States, 2007a: 3). The INTERTANKO proposal was formalised by various working groups as one of several options for regulation. It was first named “option C” by BLG 11 in November 2006 (Secretariat, 2006a: 6), and following a period where a wider variety of options were discussed, it ended as “option 1” of 3 in February 2008, by the working group set up to boil down the various options before deciding on the final regulatory outcome at MEPC 57 (Working Group, 2008: 9).

The surrounding societal and institutional context of the negotiations appears to have played an important role in propelling the relatively stringent INTERTANKO proposal forward. Based on IMO discussions, three elements are of particular importance here: (a) the growing mass of scientific evidence emphasising the health and environmental consequences of weak regulation; (b) the fact that similar emissions from land-based sources were already regulated, making shipping and IMO appear like environmental laggards, and; (c) the fact that stricter environmental regulation of shipping was already occurring on a regional and local basis, threatening a fragmentation of the global regulatory framework. In his welcoming address to BLG 10 in April 2006, the Secretary-General of IMO argued that “shipping’s environmental credentials [are] under sharper scrutiny than ever before as society [comes] to terms with the understanding that this planet and its resources [are] not limitless”, and that it was important “to ensure that its activities were environmentally friendly and sustainable” (Secretariat, 2006b: 5).

As the voice of the environmental movement, Friends of the Earth International frequently pointed out that “public awareness grows concerning the level of ship emissions of air pollution especially compared to land-based sources like cars and trucks”, with the consequence that “political pressure on national and local regulators around the world will become increasingly stronger for steep reductions” (FOEI, 2006: 2). It was important for all corporate actors to retain IMO as the core global authority on shipping regulation, and the sets of regulatory options that were developed were explicitly evaluated based on their relative risk of leading to unilateral regulatory action by states, which meant that stricter regulation was preferred as far as possible (see Secretariat, 2007: annex). Attempts by the oil industry to question the need for stringent regulation was strongly rejected by both the environmental organisations and the United States, which referred to the growing body of science emphasising the need for further reductions (OCIMF, 2007; United States, 2007b).

The final agreement looked a lot like the INTERTANKO proposal, with amendments to accommodate the concerns of the oppositional business groups. It was hammered out as a package deal in a working group consisting of all major industry actors and interested member states, under the leadership of Mr Wood-Thomas from the United States, and was unanimously agreed upon by the group without any square brackets (Secretariat, 2008b: 38-42). The deal involved a global sulphur limit of 0.5% to enter into force on 1 January 2020 (delaying the 2015 deadline suggested by INTERTANKO), subject to a fuel availability review to be completed by 2018 at the latest (a failed review would result in the deadline defaulting to 2025). INTERTANKO’s proposal to make distillate fuels the only acceptable method of compliance was not adopted, thus meeting the broad industry request for performance requirements (ibid.: 41). This deal was adopted by the Committee at MEPC 58 in October of the same year (Secretariat, 2008c: 49). Following the positive review in 2016, the 2020 deadline was fixed by MEPC, which meant that the new global sulphur cap could no longer be changed and would enter into force on 1 January 2020 (IMO, n.d.c: 2).

The power of “business” to capture the regulatory process was limited by several factors. Firstly, business did not act as a monolithic bloc, but had fragmented preferences, which resulted in a lack of agreement on technological and economic possibilities (a core feature of the structural power of business). This severely hampered the ability of oppositional industry groups to discursively determine the limits of regulation, resulting in a scientific tug-of-war. Secondly, environmental norms (societal pressure) were so strong that the opposing parties were forced to frame their arguments in terms of net environmental benefit, and non-regulation was quickly removed as an option. This pressure to regulate meant that IMO could lose its legitimacy as an environmental regulator if it did not act, and states threatened unilateral action. This would have created an unpredictable and uneven economic playing field which was not desirable for any of the actors involved. Nevertheless, the (sometimes extreme) concern raised by the oppositional business actors had the impact of softening the new requirements, indicating that regulation is still constrained by industry’s perceived capacity to comply.

This section has established that INTERTANKO’s stringent proposal for a global sulphur cap was very influential in the negotiations. The final agreement adopted INTERTANKO’s caps but contained more lenient deadlines, and it also contained performance requirements rather than technical requirements. The timing of INTERTANKO’s proposal was important, as it created a reference point for the subsequent discussions. Regulatory pressure on IMO was created by the fact that equivalent emissions from land-based sources had already been regulated, and that many states were considering or had already adopted stricter national requirements. Given corporate actors’ degree of influence at IMO, it would not be in their interest to see IMO lose its position as the legitimate regulator of global shipping. As a consequence, a compromise was reached in which a significant cap on the global sulphur emissions was adopted, but without fuel requirements, meaning that shipowners may use whichever abatement technologies they prefer in order to comply with the 0.5% cap.

Discussion

In terms of grand theory, the findings support the neo-pluralist argument. The findings do reflect the fact that corporate actors have structural power, as the oil industry’s concern about fuel availability and threats to global energy markets resulted in more market-friendly compliance options than the proposal that was originally on the table, but they do not support the structuralist assumption that globalisation has somehow completely eroded the power of the inter-state system and IMO to regulate firms, as was suggested by Michael Roe (2013). The findings also show that it is not useful to treat business as a unitary actor. In the case of sulphur regulation, business conflict served to destabilise the certainty around which policy options were technologically and economically feasible, which widened the scope of possible policy outcomes. The recognition of business conflict is important because the very idea that business is unified and ungovernable in a globalised world could suggest that attempts at multilateral regulation is a hopeless project which must be left to the free market. Given the private sector’s track record of self-governance, it currently seems like the IMO is the best option to ensure an environmental regime with broad participation (and hopefully, with time, greater transparency).

The findings also lend support to the literature that emphasises the importance of the organisational field and societal demand for regulation. The discussions at IMO were heavily influenced by the fact that sulphur emissions from land-based sources had already been regulated following growing scientific evidence on the health and environmental impacts of sulphur emissions (such as acid rain). The threat of unilateral regulatory action by states, and the fear that IMO would lose its legitimacy as the main authority on global shipping regulation, had a definite impact on the negotiations. The findings also reflected the fact that global environmental norms are gaining ground relative to those of the free market, as it was impossible for corporate actors to justify their preferred policy options on the grounds of economics alone. A discourse of “net environmental benefit” emerged, which was of questionable effectiveness as it was consistently challenged by the ENGOs and other actors in favour of regulation.

Vormedal’s (2010) expectation that industry preferences and strategies would shift over time was also reflected in the findings. The first actor to assume leadership was the group of states that suggested an amendment to the sulphur cap, but the INTERTANKO proposal can be seen as the beginning of a tipping point after which opposition was no longer a safe strategy to pursue, and the oppositional industry actors gradually started to propose softer regulation. There were therefore several points during the negotiation process which required a change in strategy. Following MEPC’s final agreement on the 2020 deadline, the previously fragmented shipping groups once again united to push for a ban on the carriage of high-sulphur fuel oil by ships that have not installed scrubbers. This makes it harder for firms to cheat by switching to high-sulphur fuels on the high seas, thus in theory making it easier to monitor and enforce compliance.

This study has primarily dealt with the negotiation stage of environmental regulation, but this stage does not exist in complete isolation from implementation and enforcement, and the difficult question of effectiveness. There are clear weaknesses in the effectiveness of the MARPOL regulations, stemming mainly from a lack of incentive for flag states to enforce them, and a lack of capacity and incentive to do so in most developing countries (Karim, 2015: 130). This reflects the structural power of shipping in the globalised economy. To a critical observer, this could suggest that the new cap is nothing more than empty virtue signalling with little substance. However, it is unlikely that the tightening of the sulphur cap will be entirely without environmental impact. Firstly, the issue has moved from a situation of almost complete regulatory capture in 1997, with a cap much higher than average global shipping emissions, to a cap which, if enforced, would significantly reduce sulphur emissions. Secondly, if a patchwork of national emission caps were to emerge, ship-owners that operate internationally would have to navigate through an international regulatory nightmare, and the environmental outcome would likely be even poorer. To truly measure the regulation’s effectiveness, one would have to observe and analyse the outcome of the power struggles and actions occurring at all scales of governance, down to the workers aboard each ship, over the next decades.

Conclusion

This research project has investigated the role of business conflict in the International Maritime Organisation’s decision to tighten the global cap on sulphur emissions in 2008. It found that a fragmentation of corporate regulatory preferences and strategies facilitated a stricter cap. INTERTANKO took on the role of regulatory entrepreneur and proposed the 0.50% global sulphur cap, which was picked up by member states and ultimately ended up in the final agreement. The oil industry and segments of the shipping industry adopted a reactionary approach and aimed to water out and delay the final agreement by mobilising arguments based on net environmental benefit, market disruptions, and lack of sufficient information. They were able to delay the new deadline and push for performance requirements rather than technical requirements on the basis of fuel availability and possibilities for market disruption, in line with structuralist expectations, but they failed to fully capture regulation at the negotiation stage. IMO was under external pressure to regulate due to the fact that sulphur emissions from land-based sources had already been regulated, and states were threatening unilateral regulatory action, which meant that IMO’s authority as the global regulator of shipping was under threat. This societal context, combined with disagreements among industry actors around whether or not a stricter cap was technologically feasible and environmentally necessary, appeared to create enough policy space to push through stringent regulation.

Even when a meaningful regulatory measure exists, the effectiveness of environmental regulation is always difficult to determine. It depends not only on the outcome of negotiations, but also on the willingness and capacity of industry to enforce it. After the 2020 deadline was fixed by MEPC in 2016, the shipping industry once again united to push for measures that would make it harder for ships to gain a competitive advantage through non-compliance. This indicates not only that conflict between business preferences can facilitate the development of a regulatory requirement, but that business preferences can shift (and unite) when the requirement is agreed upon, making it easier to enforce. These findings suggest that it is somewhat premature to write off IMO as a regulatory institution lost to corporate capture, especially given the apparent failures of private initiatives, and that its ability to regulate must be studied within the context of each specific environmental issue area, taking into account the industry power and preferences that prevail here.

Bibliography

Abbott, K.W. and Snidal, D. (2009) “The Governance Triangle: Regulatory Standards Institutions and the Shadow of the State”, in Mattli, W. and Woods, N. (eds) The Politics of Global Regulation, (Princeton University Press).

Auld, G. and Gulbrandsen, L.H. (2016) “Private Regulation in Global Environmental Governance”, in Falkner, R. (ed) The Handbook of Global Climate and Environment Policy (Chichester: Wiley Blackwell).

Bloor, M. et al. (2013) “Room for Maneuvre? Regulatory Compliance in the Global Shipping Industry” Social and Legal Studies (22:2), 171-189.

Clapp, J. (1998) “The Privatisation of Global Environmental Governance: ISO 14 000 and the Developing World” Global Governance (4:3), 295-316.

Falkner, R. (2008) Business Power and Conflict in International Environmental Politics, (Basingstoke: Palgrave Macmillan).

Fuchs, D.A. (2007) Business Power in Global Governance,(Boulder, CO.: Lynne Rienner Publishers).

Hackmann, B. (2012) “Analysis of the Governance Architecture to Regulate GHG Emissions from International Shipping” International Environmental Agreements: Politics, Law and Economics (12:1), 85-103.

Halff, A. (2017) “Slow Steaming to 2020: Innovation and Inertia in Maritime Transport and Fuels”, policy paper, Columbia Center on Global Energy Policy, August, accessed at https://energypolicy.columbia.edu/sites/default/files/SlowSteamingto2020InnovationandInertiainMarineTransportandFuels817.pdf, 24 June 2019.

Hilmola, O. (2015) “Shipping Sulphur Regulation, Freight Transportation Prices and Diesel Markets in the Baltic Sea Region” International Journal of Energy Sector Management (9:1), 120-132.

IMO [The International Maritime Organisation] (n.d.a) “Non-Governmental Organisations Which Have Been Granted Consultative Status with IMO”, accessed at http://www.imo.org/en/About/Membership/Pages/NGOsInConsultativeStatus.aspx, 13 August 2019.

IMO [The International Maritime Organisation] (n.d.b) “International Convention for the Prevention of Pollution from Ships”, accessed at http://www.imo.org/en/About/Conventions/ListOfConventions/Pages/International-Convention-for-the-Prevention-of-Pollution-from-Ships-(MARPOL).aspx, 13 August 2019.

IMO [The International Maritime Organisation] (n.d.c) “The 2020 Global Sulphur Limit”, information sheet, accessed at http://www.imo.org/en/MediaCentre/HotTopics/GHG/Documents/2020%20sulphur%20limit%20FAQ%202019.pdf, 14 August 2019.

InfluenceMap (2017) Corporate Capture of the International Maritime Organization: How the Shipping Sector Lobbies to Stay Out of the Paris Agreement, October, accessed at https://influencemap.org/site/data/000/302/Shipping_Report_October_2017.pdf, 7 July 2019.

Karim, M.S. (2015) Prevention of Pollution of the Marine Environment from Vessels: The Potential and Limits of the International Maritime Organisation, (Cham: Springer).

Levy, D.L. and Egan, D. (1998) “Capital Contests: National and Transnational Channels of Corporate Influence on the Climate Change Negotiations” Politics & Society (26:3), 337-361.

Levy, D.L. and Newell, P. (2005) The Business of Global Environmental Governance,(Cambridge, MA: MIT Press).

Lister, J., Poulsen, R.T. and Ponte, S. (2015) “Orchestrating Transnational Environmental Governance in Maritime Shipping” Global Environmental Change (34), 185- 195.

Mattli, W. and Woods, N. (2009) “In Whose Benefit? Explaining Regulatory Change in Global Politics” in Mattli, W. and Woods, N. (eds), The Politics of Global Regulation,(Princeton University Press).

May, C. (ed), (2006) Global Corporate Power,(Boulder, CO.: Lynne Rienner Publishers).

Meckling, J. (2015) “Oppose, Support, or Hedge? Distributional Effects, Regulatory Pressure, and Business Strategy in Environmental Politics” Global Environmental Politics (15:2), 19-37.

Roe, M. (2013) “Maritime Governance and Policy-Making: The Need for Process Rather than Form” The Asian Journal of Shipping and Logistics (29:2), 167-186.

Stopford, J.M., Strange, S. and Henley, J.S. (1991) Rival States, Rival Firms: Competition for World Market Shares,(Cambridge: Cambridge University Press).

Tan, A.K. (2006) Vessel-Source Marine Pollution: The Law and Politics of International Regulation,(Cambridge: Cambridge University Press).

Transparency International (2018) Governance at the International Maritime Organisation: The Case for Reform, July, accessed at https://www.transparency.org/whatwedo/publication/governance_international_maritime_organisation, 7 July 2019.

Vormedal, I. (2017) “Corporate Strategies in Environmental Governance: Marine Harvest and Regulatory Change for Sustainable Agriculture” Environmental Policy and Governance (27:1), 45-58.

Vormedal, I. (2010) “States and Markets in Global Environmental Governance: The Role of Tipping Points in International Regime Formation” European Journal of International Relations (18:2), 251-275.

Wuisan, L., Leeuwen, J. and Koppen, C.S.A. (2012) “Greening International Shipping Through Private Governance: A Case Study of the Clean Shipping Project” Marine Policy (36:1), 165-173.

Yliskylä-Peuralahti, J. and Gritsenko, D. (2014) “Binding Rules or Voluntary Actions? A Conceptual Framework for CSR in Shipping” WMU Journal of Maritime Affairs (13:2), 251-268.

IMO Documents

BIMCO [Baltic and International Maritime Council] (2008) Prevention of Air Pollution from Ships: Comments on the outcome of BLG 12 on the review of MARPOL Annex VI and the NOx Technical Code, (London: The International Maritime Organisation) MEPC 57/4/36.

Finland et al. (2005) Prevention of Air Pollution from Ships: MARPOL Annex VI – Proposal to Initiate a Revision Process, (London: The International Maritime Organisation) MEPC 53/4/4.

FOEI [Friends of the Earth International] (2007a) Review of MARPOL Annex VI and the NOx Technical Code: New Global Study Estimating Premature Deaths Caused by Air Pollution from International Shipping, (London: The International Maritime Organisation) BLG 12/6/9.

FOEI (2007b) Review of MARPOL Annex VI and the NOx Technical Code: Holistic approach of the revision process of MARPOL Annex VI: Impacts of heavy fuel oil, (London: The International Maritime Organisation) BLG 11/5/16.

FOEI (2006) Review of MARPOL Annex VI and the NOx Technical Code: Strengthening Annex VI Limits for Shipping Emissions of Air Pollution, (London: The International Maritime Organisation) BLG 10/14/13.

ICS [The International Chamber of Shipping] (2007) Revision of MARPOL Annex VI and the NOx Technical Code: A goal-based approach to emission reduction, (London: The International Maritime Organisation) BLG 10/5/8.

ICS et al. (2017) Consistent Implementation of Regulation 14.1.3 of MARPOL Annex VI: Proposal for a prohibition on the carriage of non-compliant fuel oil for combustion purposes with a sulphur content exceeding 0.50% m/m and suggestions for guidelines to promote effective and consistent implementation of regulation 14.1.3 of MARPOL Annex VI, (London: The International Maritime Organisation) PPR 5/13/7.

ICS et al. (2006) Review of MARPOL Annex VI and the NOx Technical Code: MARPOL Annex VI Revision – The Shipping Industry Perspective, (London: The International Maritime Organisation) BLG 10/14/5.

ICS (2006) Revision of MARPOL Annex VI, the NOx Technical Code and Related Guidelines, (London: The International Maritime Organisation) BLG-WGAP 1/2/5.

INTERTANKO [The International Association of Independent Tanker Owners] (2007) Review of MARPOL Annex VI and the NOx Technical Code: Global use of low sulphur marine distillates – Consequence assessments, (London: The International Maritime Organisation) BLG 12/6/31.

INTERTANKO (2006) Revision of MARPOL Annex VI, the NOx Technical Code and Related Guidelines: Proposed Amendments to MARPOL Annex VI, (London: The International Maritime Organisation) BLG-WGAP 1/2/5.

IPIECA [International Petroleum Industry Environmental Conservation Association] (2007a) Review of MARPOL Annex VI and the NOx Technical Code: Global environmental impact and marine fuel supply impact of proposed options to revise MARPOL Annex VI, (London: The International Maritime Organisation) BLG 11/5/14.

IPIECA (2007b) Prevention of Air Pollution from Ships: The Annex VI revision process: a statement from refiners on proposed changes to the marine fuel supply chain, (London: The International Maritime Organisation) MEPC 57/4/26.

IPIECA and OCIMF [Oil Companies International Marine Forum] (2007) Review of MARPOL Annex VI and the NOx Technical Code: Comments on Document BLG 12/6/9 – Global Study estimating premature deaths caused by air pollution from international shipping, (London: The International Maritime Organisation) BLG 12/6/33.

IPIECA and OCIMF (2006a) Revision of MARPOL Annex VI and the NOx Technical Code: Environmental Impact of SOx Emissions from International Shipping and Considerations on the Supply of Low Sulphur Bunker Fuels, (London: The International Maritime Organisation) BLG-WGAP 1/2/13.

IPIECA and OCIMF (2006b) Review of MARPOL Annex VI and the NOx Technical Code: MARPOL Annex VI: Key refining and supply issues for consideration by BLG in the MARPOL Annex VI technical review process, (London: The International Maritime Organisation) BLG 10/14/14.

IPIECA and OCIMF (2006c) Revision of MARPOL Annex VI and the NOx Technical Code: Environmental Impact of SOx emissions from international shipping and considerations on the supply of low sulphur bunker fuels, (London: The International Maritime Organisation) BLG-WGAP 1/2/13.

Norway (2007) Review of MARPOL Annex VI and the NOx Technical Code: Comments on the report of the first intersessional meeting of the BLG Working Group on Air Pollution – proposal for new global sulphur limits and fuel specification, (London: The International Maritime Organisation) BLG 11/5/24.

Norway (2005) Review of MARPOL Annex VI and the NOx Technical Code: MARPOL Annex VI Revision – Proposals Related to Future Emission Limits and Issues for Clarification, (London: The International Maritime Organisation) BLG 10/14/2.

OCIMF (2007) Review of MARPOL Annex VI and the NOx Technical Code: Commentary on the need for responsible environmental stewardship in consideration of further reduction of air emissions from ships, (London: The International Maritime Organisation) BLG 11/5/9.

Secretariat (2008a) Prevention of Air Pollution from Ships: Sulphur monitoring for 2007, (London: The International Maritime Organisation) MEPC 57/4/27.

Secretariat (2008b) Report of the Marine Environment Protection Committee on its Fifty-Seventh Session, (London: The International Maritime Organisation) MEPC 57/21.

Secretariat (2008c) Report of the Marine Environment Protection Committee on its Fifty-Eighth Session (London: The International Maritime Organisation) MEPC 58/23.

Secretariat (2007) Review of MARPOL Annex VI and the NOx Technical Code: Options for Reduction of Sulphur Oxides Emissions, (London: The International Maritime Organisation) BLG 11/5/1.

Secretariat (2006a) Revision of MARPOL Annex VI, the NOx Technical Code and Related Guidelines: Report of the Outcome of the Intersessional Meeting of the BLG Working Group on Air Pollution, (London: The International Maritime Organisation) BLG 11/5.

Secretariat (2006b) Report to the Maritime Safety Committee and the Marine Environment Protection Committee, (London: The International Maritime Organisation) BLG 10/19.

Secretariat (2005) Report of the Marine Environment Protection Committee on its Fifty-Third Session, (London: The International Maritime Organisation) MEPC 53/24.

Sweden (2007) Review of MARPOL Annex VI and the NOx Technical Code: Comments Related to Fuel Issues and the Sole Use of Low Sulphur Distillates Fuel, (London: The International Maritime Organisation) BLG 11/5/19.

United States (2007a) Review of MARPOL Annex VI and the NOx Technical Code: Development of Standards for NOx, PM and SOx, (London: The International Maritime Organisation) BLG 11/5/15.

United States (2007b) Review of MARPOL Annex VI and the NOx Technical Code: Air quality concerns from particulate matter and oxides of sulphur, (London: The International Maritime Organisation) BLG 11/5/27.

United States (2006) Revision of MARPOL Annex VI, the NOx Technical Code and Related Guidelines: Report of Correspondence Group A, (London: The International Maritime Organisation) BLG-WGAP 1/2/1.

Working Group (2008) Review of MARPOL Annex VI and the NOx Technical Code: Report of the Working Group, (London: The International Maritime Organisation) BLG 12/WP.6.

Written at: The London School of Economics

Written for: Dr. Robert Falkner

Date written: August 2019

Further Reading on E-International Relations

- Mercenaries of Peace: The Role of Private Military Contractors in Conflict

- Navigating the Complexities of Business and Human Rights

- The Emergent Role of Cities as Actors in International Relations

- Protecting the Defenders: Exploring the Role of Global Corporations and Treaties

- The Role of Global Governance in Curtailing Mexican Cartel Violence

- Reform of the Global Financial Architecture: The Role of BRICS and the G20