“If the economic war continues against Venezuela, the price of oil is going

to reach $200 [a barrel] and Venezuela will join the economic war.” -Hugo Chavez, President of Venezuela

Introduction

The United States is currently feeling the pinch when it comes to purchasing oil. Economists are looking for ways to relieve the pinch at the pump. Research is being done to look into alternative ways that the United States could meet its oil needs. Though there is research being done to find alternative measures, there is no timeline for when the United States will find that measure to combat oil prices. Until then, the United States must continue to purchase oil abroad. One of its main exporters is Venezuela.

Hugo Chavez, president of Venezuela, since coming to office has made it a point to undermine the United States and its influence in the Latin American region. Venezuela has threatened to cut oil exports to the United States. Is there a possibility that Venezuela could potentially stop its oil exports to the United States? What is the likelihood of this happening and should it occur, what will be the result(s)? The likelihood of Venezuela cutting exports to the United States is very low. Should Venezuela decide to cut those exports anyway, Venezuela will look elsewhere in the world to make up for its losses thus raising oil prices and slowing economic growth in the United States.

Background

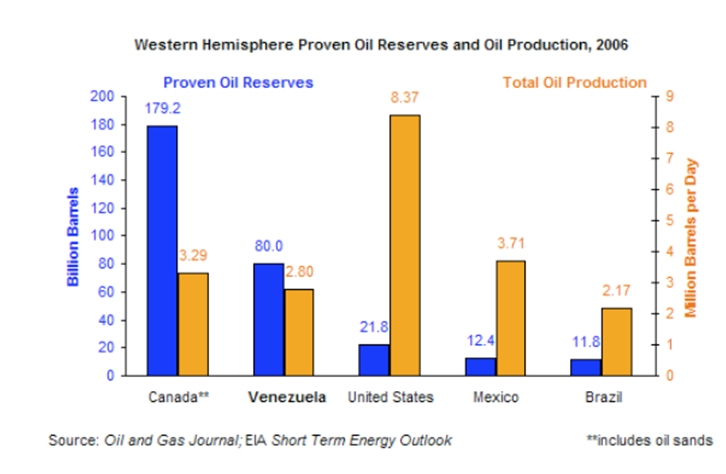

Venezuela is one of the top ten producers of crude oil. “Venezuela has 6.8% of the world’s proved reserves, that is, 80 billion barrels, making it the sixth-richest oil nation after Saudi Arabia, Iran, Iraq, Kuwait, and Abu Dhabi” (Herrera 2006, 6). The following graph taken from the Energy Information Administration shows the Western Hemisphere’s oil reserves and oil production levels.

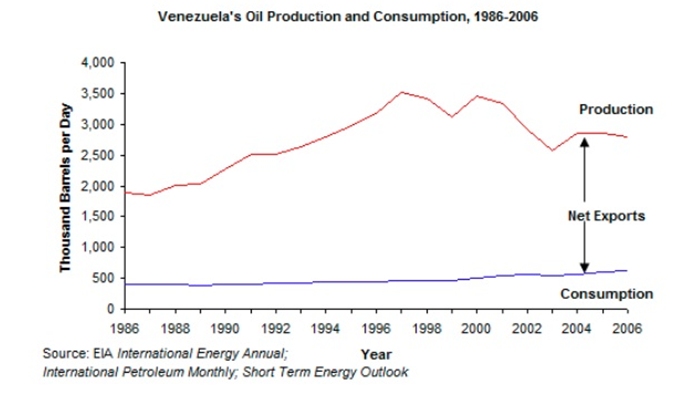

Venezuela’s state-owned petroleum company PDVSA (Petroléos de Venezuela, S.A.) is the third largest oil company in the world, the first two being Saudi Arameo and ExxonMobil. In the late 70s PDVSA was nationalized thus becoming its own entity to control the state’s wealth. “In 2002, Chavez redefined PDVSA’s role to include the government’s social priorities” (Alvarez 2008, 2). It is unclear as to what the production levels are from Venezuela’s reserves because with PDVSA being state-owned it does not have to report its production levels to the U.S. Securities and Exchange Commission (SEC). The following graph, provided by the EIA (Energy Information Administration), shows Venezuela’s oil production and consumption between 1986-2006. “Independent analysts and EIA estimate that [PDVSA] around 1.6 million bbl/d of crude oil in 2006, or around 60 percent of Venezuela’s total crude oil production” (Energy Information Administration 2007, 4).

10 percent of PDVSA’s income is spent on social programs. In 2007, according to International Oil Daily, an energy trade publication, PDVSA spent $14.4 billion on social programs. “These programs include projects such as medical clinics providing free health care, discounted food and household goods centers in poor neighborhoods, indigenous land-titling, job creation programs outside of the oil business, and university and education programs” (Alvarez 2008, 2).

“These new priorities divert billions of dollars per year away from oil-related activities” (Energy Information Administration 2007, 3). Chavez has also used these monies to gain support in the Western Hemisphere.

“According to Venezuela’s daily El Nacional, during the second half 2005 and the first month of 2006 Venezuela agreed to spend $25.9 billion in economic aid to its hemisphere partners, with the three largest amounts going to Brazil ($4.38 billion), Cuba ($4.34 billion), and Argentina ($3.95 billion)” (Lapper 2006, 15).

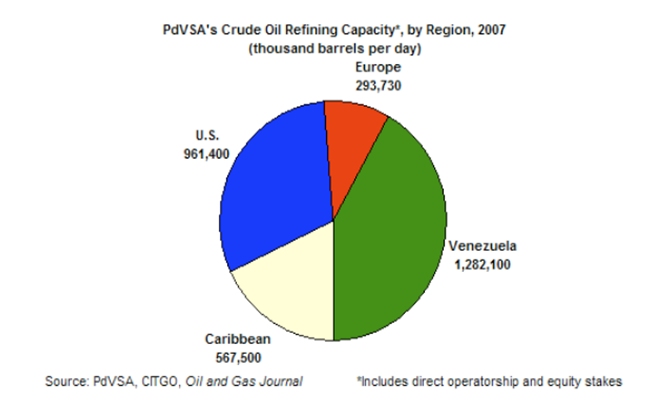

In 2007, the Associated Press estimated that Venezuela had promised Latin American and Caribbean states $8.8 billion in aid, financing, and energy funding. In 1980 PDVSA acquired CITGO, one of the United States’ refineries, which has become one of the world’s largest refineries. “PDVSA also wholly owns five refineries in the United States and partly owns four refineries, either through partnerships with U.S. companies or through PDVSA’s U.S. subsidiary, CITGO” (Alvarez 2008, 3).

In the 90s Venezuela opened its oil sector to private investment. This is turn created 32 operating service agreements (OSA) with 22 different foreign oil companies. These companies include BP, Chevron, and Total. These international oil companies operate the oil fields and then have their fees paid for and the crude oil they produce by PDVSA. “In 2002, the Venezuelan economy experienced a significant downturn following a failed military coup to overthrow Chavez and a two-month strike by the state-run oil company PDVSA” (Alvarez 2008, 1). Chavez, because of his control over a large portion of the world’s oil reserves, has used oil as a foreign policy instrument.

The United States is highly dependent on oil. “The United States is the world’s largest consumer of oil, accounting for 25 percent of global daily demand despite holding less than 3 percent of the world’s proven reserves” (International Energy Annual 2005, 8.1). Ground and air transportation are the two primary users of oil in the U.S. The price of oil has doubled since 2005 and it does not seem to show any signs of dropping. There are limited sources from which the United States can acquire the oil it needs to sustain itself. In the event that Venezuela pulls out its exports to the United States then the U.S. will be thrown into a spin economically. Also, Venezuela has signed agreements with India and China to reduce American power. As a result, Venezuela has increased its oil supplies to these countries and American customers have been affected. So should Venezuela stop providing the U.S. with oil it will make up for its losses by providing China and India with oil, two countries whom all ready are big competitors in the global market.

In February 2008, Chavez threatened to cut off exports to the United States because Venezuela is being pursued by international courts, which are investigating ExxonMobil’s contract dispute against Venezuela and its state-owned oil company PDVSA. “Chavez lashed out after ExxonMobil’s recent success in obtaining court orders in Britain, the Netherlands, and the Netherlands Antilles freezing up to $12 billion in Venezuelan state assets” (Mufson 2008, 1). In turn the U.S. convinced a New York federal court to freeze $300 million in funds held in a joint venture between PDVSA and ExxonMobil. This all came to be when “Exxon filed its arbitration cases after Chavez ordered Petroleos de Venezuela in May to seize control of two Exxon-operated ventures in the Orinoco region as part of a campaign to nationalize key industries” (Musof 2008, 1). Venezuela and Exxon couldn’t agree on compensation for the sequestered portion of the joint venture. Exxon walked away from the venture, received a $750 million write-off, and filed suit against Venezuela.

Arguments

With current oil prices fluctuating daily, the United States’ economic security is not completely safe. A study that was done by the General Accounting Office (GAO) shows that, “a 6-month disruption of crude from Venezuela ‘would result in a significant increase in crude oil prices and lead to a reduction of up to $23 billion in U.S. gross domestic product’” (Fleischman 2006, 5). The study continues by stating that although a short-term reduction in oil production would be manageable by the United States a “long-term curbs on Venezuela oil production and exports should be ‘a concern for U.S. security, especially in light of current tight supply and demand conditions in the world market’” (Ibid.).

The U.S. is relying on oil from weak and unstable states. Venezuela falls under this category. “The UK Prime Minster’s office calculates that some 43% of global oil reserves (17% of global gas reserves) are located in countries ‘at risk of instability’…” (Patrick 2006, 26). The United States’ current economy cannot afford to be working with these unstable states but because of its dependency on oil from these places; it will continue to feel the blows that come with oil diplomacy. Chavez is the primary example. As mentioned before Chavez is looking how to undermine the United States and for ways to reduce the United States’ influence in the Western Hemisphere. U.S. foreign policy and national security objectives cannot be put on the backburner just to fulfill its demand for oil. As for Latin American states, “most Latin American governments are hardly marching in lockstep with the Venezuelan president and are resisting joining a hostile, anti-U.S. bloc” (Shifter 2006, 3).

The U.S. military, primarily the Navy, will also feel the effects of high crude prices. “The Navy Exchange (NEX) buys its gasoline from a company owned by Venezuelan Dictator – President Hugo Chavez” (Roberts 2008, 1). The NEX has a contract with CITGO that runs until 2010. “A Navy press spokesman says that ‘CITGO’s competitively bid $60 million-a-year contracts to supply the Navy Exchange with gas run through 2010…CITGO’s relationship with the exchange dates back to 1989” (Ibid., 2).

The likelihood of Venezuela cutting oil exports is highly unlikely. “Venezuela beleaguered by food shortages, depends heavily on oil exports for about 90 percent of its export earnings and about half of the government revenue” (Mufson 2008, 1). The United States is Venezuela’s biggest customer. Halting crude sales would affect CITGO. “Halting crude sales to the U.S. would divert heavy feed from CITGO, which PDVSA owns and which has a total of 756,000 b/cd of deep-conversion capacity in three wholly owned U.S. refineries – 597,000 b/d of it on the Gulf Coast” (Oil & Gas Journal 2008, 21). According to Oil & Gas Journal, “If Chavez did lose his senses and halts sales of Venezuelan oil in the U.S., crude prices might jump in a trading panic but would quickly resettle as U.S. refineries found new sellers – probably the traders moving in to buy from PDSA” (Oil & Gas 2006, 21). Also, Venezuelans are importing more U.S. products such as construction machinery, cars, and computers. “Although it may be Chavez’s ultimate desire to end U.S.-Venezuelan interdependence, such close economic linkages cannot be easily dismantled” (Lapper 2006, 17).

Not only would the stopping of oil exports hurt Venezuela’s economy, it would affect U.S. foreign aid being sent there. “According to the State Department’s fiscal year 2007 budget, Venezuela will receive $1 million in Andean Counter Drug Initiative funds this year – a decrease of nearly $2 million since 2005 – and $1.5 million in Economic Support Funds to strengthen civil society and the rule of law” (Lapper 2006, 23).

Venezuela is looking to China to pickup the losses should it decide to cut exports to the U.S. Chinese imports have soared making them the second largest oil importer in the world. These imports have risen to support Chinas economic growth it is experiencing. “The Chinese currently import just over 100,000 barrels per day from Venezuela, and they have committed to purchasing 500,000 barrels per day by 2011. Moreover, Beijing has agreed to provide Venezuela with ‘supertankers’ for transoceanic shipment and construct twelve new offshore drilling sites” (Lapper 2006, 14).

There is also the problem with the Iran-Venezuela-Russia alliance. This alliance has produced a threat to the United States’ economic security. These three countries alone account for 30 percent of the world’s oil exports.

“These three countries can dictate international oil prices. By extension, these three countries can also dictate inflation and economic growth rates in the world’s largest oil-consuming countries, which are enormously dependent on oil imports” (Gundzik 2005, 3).

In relation to deals signed between Russia and Venezuela, in 2006 Venezuela “purchased 100,00 Kalashnikov rifles, twenty-four Sukohi-30 fighter planes, and fifty-three Russian helicopters” (Alvarez 2006, 2). This purchase of weapons is cause for concern in regards to U.S. national security.

Conclusion

Global consumption of oil will continue to grow as the years pass. The United States is overly dependent on oil imports to meet its demand to supply its industries. The U.S. must look to find alternatives should Venezuela decide to halt all oil imports to the United States. This threat is a weak threat considering the possible outcomes that would hamper Venezuela. If the U.S. plans to bounce back from the economic hit that would come with Venezuela pulling oil exports, then it must begin to create a strategy that will cushion the blow.

This topic must continue to be researched and updated. The United States is in an election year and the economy is one of the top topics that U.S. consumers are looking to find solutions for. They are feeling the pinch at the pump and want to find new means of softening oil prices. The demand will continue to rise when the supply may be depleting.

Venezuela needs the United States to buy its oil, which is clear. Venezuela is a weak and unstable state that the U.S. must be careful when it is doing business with an authoritarian like that of Chavez. His feeble threats to the United States make cause a raucous in the U.S. economy but if it wants to continue to do business with the U.S. and be able to profit from that business as it needs to, then it will avoid making such threats to a super power like that of the United States.

References

Alvarez, Cesar. “Venezuela’s Oil-Based Economy.” Council on Foreign Relations. Available from http://www.cfr.org/publication/12089/venezuelas_oilbased_economy.html. Internet; accessed 30 July 2008.

Cohen, Ariel. “The National Security Consequences of Oil Dependency.” Available from http://www.heritage.org/research/nationalsecurity/hl1021.cfm. Internet; accessed 26 October 2007.

Energy Information Administration. “Venezuela.” Energy Information Administration. Available from http://www.eia.doe.gov/cabs/Venezuela/pdf.pdf. Internet; accessed 31 July 2008.

Fleischman, Luis. Fall 2006. Venezuela: Anatomy Of A Dictator. The Journal of International Security Affairs no. 11. http://securityaffairs.org/issues/2006/11/fleischman.php. Internet; accessed 20 November 2007.

Gundzik, Jephraim. 2005. “Self-made threat to US oil and security.” Asia Times Online. Available from http://www.atimes.com/atimes/Middle_East/GK03Ak03.html. Internet; accessed 18 October 2007.

Herrera, Genaro. “Oil and gas in Latin America. An analysis of politics and international relations from the perspective of Venezuelan policy..” Real Instituto Elcano. Available from http://www.realinstitutoelcano.org/documentos/268.asp. Internet; accessed 11 October 2007.

International Energy Annual. “Energy Information Administration.” Table 8.1. World Energy Reserves. Available from http://eia.doe.gov/iea/res.html. Internet; accessed 31 July 2008. Quoted in Secure Energy, “Oil Dependence – A Threat to U.S. Economic and National Security.” Secure Energy. Available from http://www.secureenergy.org/files/files/155_Briefing-OilDependence.pdf. Internet; accessed 11 October 2007.

Lapper, Richard. “Living with Hugo Chavez: U.S. Policy Toward Hugo Chavez’s Venezuela.” Council Special Report, no. 20 (2006): 1-43. Available from http://www.cfr.org/content/publications/attachments/VenezuelaCSR.pdf. Internet; accessed 11 October 2007.

Mufson, Steven. “Chavez Threatens to Halt Venezuela’s Oil Sales to U.S..” Washingtonpost.com. Available from http://www.washingtonpost.com/wp-dyn/content/article/2008/02/10/AR2008021001381.html. Internet; accessed 30 July 2008.

Oil & Gas Journal. February 18, 2008. The empty Chavez blather. Oil & Gas Journal. Pg. 21. Availabe from http://www.ogj.com/display_article/320278/7/ARCHI/none/none/1/The-empty-Chavez-blather/ . Internet; accessed 30 July 2008.

Patrick, Stewart. “Weak States and Global Threats: Assessing Evidence of ‘Spillovers’.” The Center for Global Development. Available from http://www.cgdev.org/content/publications/detail/5539. Internet; accessed 30 July 2008.

Roberts, James. “How the U.S. Navy Inadvertently Supports Hugo Chavez.” The Heritage Foundation. Available from http://author.heritage.org/Research/NationalSecurity/wm1855.cfm. Internet; accessed 8 April 2008.

Shifter, Michael. “In Search of Hugo Chavez.” Available from http://www.foreignaffairs.org/20060501faessay85303/michael-shifter/in-search-of-hugo-ch-vez.html?mode=print. Internet; accessed 26 October 2007.

—

Written by: Frances Arias

Written at: American Military University

Date written: 2008

Further Reading on E-International Relations

- Shifting Hegemony: China’s Challenge to U.S. Hegemony During COVID-19

- Rogue Relations under Max-Pressure: Iran-Venezuela Bilateral Engagement 2013–2020

- To What Extent Is ‘Great Power Competition’ A Threat to Global Security?

- Israel’s Qualitative Military Edge: U.S. Arms Transfer Policy

- The Puzzle of U.S. Foreign Policy Revision Regarding Iran’s Nuclear Program

- Jimmy Carter’s Liberalism: A Failed Revolution of U.S. Foreign Policy?