Globally systematically important banks – otherwise known as “Too Big To Fail” (TBTF) banks – have become the symbol of both the success and failure of this early 21th century financial capitalism. The 2007 financial crisis crudely revealed to taxpayers that, contrary to virtually anybody else and in contravention of the basic principles of classical economic theory, some firms just could not be let go bankrupt. The terms of the blackmail were quite simple: public money had to be used to bail the banks out, or else, those banks would wreak havoc on the world’s financial systems and economies. At different levels of governance and in different venues, regulators discussed which policies would be most effective to tackle the TBTF banks problem.

Supranational organizations like the G20, the Financial Stability Board (FSB), the International Organizations of Securities Commission (IOSCO) and the Basel Committee on Bank Supervision (BCBS) have laid out important common standards and objectives for financial stability (Rottier and Veron 2010, Posner and Newman 2018). The creation of the European Banking Union and the new supervisory power of the ECB has also affected European banks (Epstein and Rhodes 2016; Schoenmaker and Veron 2016; Howarth and Quaglia 2016, 2018). Finally, because European banks operate in the US through their foreign branches or subsidiaries, they are impacted by banking reforms implemented in this country (Emmeneger and Eggenberger 2018). Surely, those arena beyond the nation-state matter greatly for the governance of financial markets. Yet, it is important to also examine the domestic politics of banking for at least two important reasons. First, regulation and standards adopted at international and supranational levels are largely shaped by states’ preferences, and then national states are the ones eventually in charge of implementing these standards and regulations (Moschella and Diodati 2020; Massoc 2017). Second, national states have more leeway in adopting their own rules than what is commonly assumed by IPE scholars, even in an area that is as globalized as banking.

Building on a comparative analysis of banking policies in France, Germany and the UK, my research shows that these three states have developed different priorities towards their large domestic banks after the crisis. I argue that these priorities have been shaped by two dynamics, one global and one domestic. In the context of a financialized global economy, the executive branches of European states – because they are in charge of fostering national competitiveness- had a strong incentive to promote the expansion of TBTF banks globally, despite the risks for financial stability. Yet, this incentive has been politically contested. Due to typical institutional legacies at the domestic level, “anti-TBTF” factions have had different resources available for them to carry weight in policymaking processes and thus limit the efforts of executive branches to promote large domestic banks. The differentiated institutional capacities of “anti-TBTF” factions in France, Germany and the UK thus explain the divergent priorities of those states towards their large TBTF banks.

The following section of the article presents the divergent priorities towards large banks in France, Germany and France. The third section examines more closely how domestic institutional legacies in France, Germany and the UK have pondered global structural dynamics and shaped different state priorities towards banking in Europe. The fourth section briefly describes the consequences of different banking policies in the three political economies.

Divergent State Priorities towards TBTF Banks in Europe: A Policy Analysis

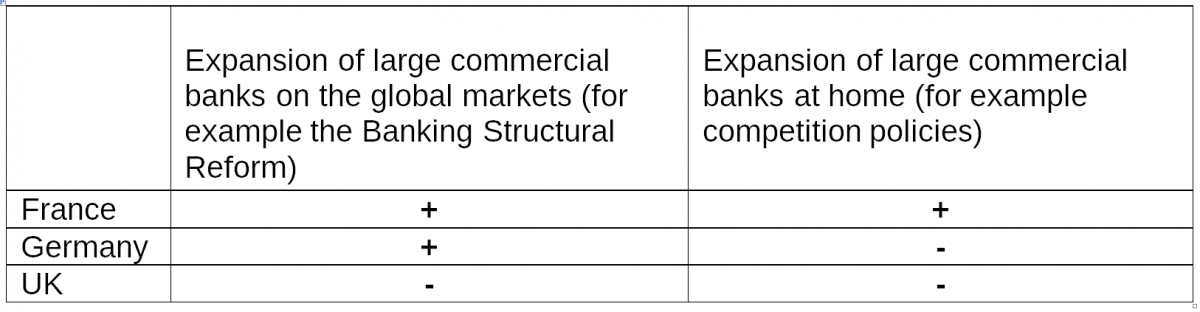

In my research, I have analyzed 12 financial policies and cases of policy enforcement in France, Germany and the UK since 2008. I have questioned each national version of a financial policy according to whether they tend to hinder/permit/enhance the expansion of large banks, globally and at home. I find that states have been proactive in shaping the evolution of finance after 2008. Yet they have promoted very different re-organizations of their domestic financial industries (Massoc 2020).

French banks have been protected, even promoted, globally and at home. For example, the refusal to implement a strict separation between retail and trading activities and the refusal to promote competition in the banking sector are revealing of the will of the state to let the banks expand globally and at home. In Germany, global activities of banks have been to a large extent protected, with for example the refusal to implement a strict separation of retail and trading activities. On the other side, the traditional turf of local public and cooperative banks – which dominate the domestic retail markets – has been fiercely protected, with for example a clear refusal to promote competition in those markets. British policies reveal an attempt to hinder large banks’ expansion, regarding activities operated both globally and at home. For example, British banks have been submitted to a tougher version of the separation between retail and market activities and to relatively ambitious projects promoting competition in domestic retail banking.

The following table sums up the signals sent by the policies analyzed: does a given policy allow (+) or hinder (–) the expansion of large commercial banks at home and globally?

Summary of States’ Priorities as Observed through Post-crisis Banking Policies

This variation is puzzling. First, scholars have stressed the convergence of these three countries towards market-based banking in the years leading up to the crisis (Hardie et al. 2013). According to both the globalization and Varieties of Capitalism (VoC) analytical frameworks, if banks have started converging, there is no reason why they should start diverging again. Second, all three countries endured significant risks and losses during the international financial crisis and/or the Euro-crisis, and all their political leaders made strong commitments in favor of far-reaching banking reform. Finally, the three countries share a common framework of European and international financial regulation. Two of them—France and Germany—have even shown a commitment to deepening their participation in a European regulatory framework through the implementation of the European banking union after the crisis, which would tend to signal that they share the same priorities towards TBTF banks. So, what explains the variation of state priorities towards banks in Europe?

Global Banks, Structural Power and Domestic Political Institutions

The traditional “quid pro quo” between banks and states was very well described by the post-war literature on comparative capitalism (Gerschenkron 1962; Zysman 1983). The terms of the quid pro quo were simple. Banks provide credit to strategic economic sectors or firms that the state wants to promote and helps in mobilizing targeted political support. In return, states provide banks with regulatory protection from outsider competition, regulatory forbearance, and fiscal support in times of crisis.

At the turn of the 21st century, following the insights of functional theories, scholars have argued that the globalization of finance had broken the traditional ties between states and banks. Banks are no longer able or willing to support states’ industrial policy because their business opportunities have gone global. States are no longer able to provide regulatory protection at the national level. The end of the structural interdependency between banks and states, they argue, has broken the very incentives for both banks and states to support the quid pro quo (Epstein 2017).

It is correct to stress that the traditional state-bank quid pro quo is no longer sustainable. Yet, I argue that the financialization of the economy has led to a different, not weaker, structural interdependency between states and banks. In a financialized economy, states depend on the growth of the banking sector itself for overall “economic growth.” Banks’ roles have changed, but their roles have become more, not less, important for the overall competitiveness of political economies that are engaged in global financialized capitalism. Far from leading to a break of state-bank ties, the financialization of the economy had led to a structural alignment of interests between states and banks. The growth of banks themselves—not the financing of industrial policy—has become an objective for states. In early 2019, when German finance Minister Olaf Scholz spoke of industrial policy, it was to push for the creation of a banking national champion.

After the crisis, it very soon became an objective for European governments to make their banks competitive again. Because executive branches are the ones accountable for growth, the incentive to promote TBTF banks is particularly strong within governments’ finance ministries and treasuries. The alignment of (perceived) interests between governments and TBTF banks could be deemed to be a case in point of large banks’ “structural power.” Indeed, because the growth of the whole economy depends on them, governments are predisposed to adopt policies that promote these firms, even without banks’ top managers necessarily having to do anything to influence them (Lindblom 1977; Culpepper 2015).

Yet, the new state-bank quid pro quo is contested and varieties remain. Varieties in banking regulation are explained by varieties of political institutions across European jurisdictions. Different factions, often led by actors from within the state itself, opposed the promotion of TBTF banks by executive branches. The capacity of these factions to shape the outcome depends on the political institutions structuring the typical policymaking process in each of these countries.

French symbiotic policymaking process

France used to be the archetypical dirigiste, or state-led, political economy. But the formal institutions that ruled the interactions between banks and states under the dirigiste model have now to a large extent disappeared. Scholars have stressed how dramatic of a rupture French capitalism had undergone (Hall et. al. 2008; Levy 1999, 2008). Yet, important aspects of the French institutional heritage have remained within less encompassing institutions. In particular, France still sticks out by the concentrated and centralized character of the organization of both its state – organized around the Treasury and the Executive (Clift 2003), and its banks – organized in the very close French Banking Federation (Coleman 1994). Also, the persistence of elites’ proximity in this country has repeatedly been underlined by French scholars (Bourdieu 1989; Chavagneux and Philipponnat 2014).

French institutions foster a symbiotic mode of coordination between state and bank elites through mechanisms of group identification and trust, as underlined in the literature on the sociology of elites (Olstrom 2000; Kwak 2013). Bank top managers and French state officials conceive of each other’s preferences as legitimate to take into account and find comfort and utility in agreeing with each other. They will prefer to find common ground when collectively shaping their preferences. When antagonism remains, they will prioritize the crafting of compromises, not the confrontational use of their power resources (Jabko and Massoc 2012).

In France, the key position in a policymaking processes has thus been held by a narrow nexus of state-bank elites, which has made it very difficult for other actors to step in. French state officials have to a large extent abided by banks’ preferences. The action of the French public authorities in banking after the crisis has consisted of not hindering the expansion of large domestic banks globally and at home, leading to a French universalist trajectory of finance.

German dual policymaking process

Germany is the poster child of the Coordinated Market Economy (Hall and Soskice 2001). Since the 1980s, it has been much discussed whether or not Germany retains its institutional distinction in terms of organization of the different areas of its political economy (Streeck 2001; Hacketal at al 2005; Hardie and Howarth 2013). Although the debates continue to this day, some typically German institutions remain very stable.

Federal governments have always considered since the 1980s that it was crucial for an economic power like Germany to have its “own” national champion. Deutsche Bank in particular is still considered as a jewel of the crown by German state officials. Deutsche Bank’s top executives enjoy a privileged access to Treasury officials and the minister of finance. Observers have dubbed Deutsche Bank “the state within the state”. On another hand, the federal government must also cope with strong coalitions composed of local governments and local public banks, to a large extent supported by the well-organized network of medium enterprises, the famously known Mittelstand. Local governments are public banks’ shareholders and local politicians sit in local state banks’ (Landesbanken’s) directorates (Choulet 2016). The preservation of the local public banks’ turf thus ranks high in the priorities of local governments, to which the federal level is largely accountable (Gunlicks 2003; Scharpf 1988).

When the preferences of TBTF banks conflict with their own priorities of protecting local banks, local governments will almost systematically overrule them. By contrast, when decisions don’t affect local banks, the policy outcome tends to conform with Deutsche Banks’ preference. This dual policymaking process explains why banking reform in Germany has sought to promote the expansion of large commercial banks globally while protecting local banks (including against commercial banks) in the domestic retail markets.

British adversarial policymaking process

Close social, political and cultural ties between the City, the Treasury and the Bank of England were characteristic of post-war UK (Gilligan, 1997). The sweeping and radical reforms of finance undertaken at the very beginning of the 1980s, known as the “Big Bang”, and which led to the increasing presence of foreign firms in London and to the integration of British banks into global markets, dramatically transformed the social character of the City (Clemons and Weber 1990). British bankers lost their social homogeneity and their special relationship to the gentlemen of the government.

Today, the British Banking Association struggles to shape common positions and doesn’t have much influence in decision-making processes. On the other side, the state is more fragmented than in France, despite the centralized nature of the British regime (Thatcher 2007). Ad hoc parliamentary committees don’t hesitate to adopt trans-partisan positions and to publicly challenge the executive. The Parliamentary Commission on Banking Standards has been particularly active in putting pressure on the Treasury to regulate banks after the crisis. The post-war cozy social ties between bankers, the regulators and the Treasury have thus been replaced by more pluralistic institutions where actors rely on the traditional tools of organized lobbying to influence each other (Froud et al. 2012).

Yet the political power of business is known to fluctuate in pluralistic contexts (Vogel 2003; Baumgartner et. al. 2009). Immediately after the crisis, state officials were infuriated by British banks, and there was no Gentlemen’s club to calm them down (Woll 2014; King 2016). Strong attacks against TBTF banks came from several fronts: the regulatory agencies, Parliamentary Commission on banking standards and the Independent Commission on Banking presided by Lord Vickers. These commissions had important material and intellectual resources to investigate what type of banking reform they would like to advocate (Bell and Hindmoore 2014, 2015; Ganderson 2020). British banks have threatened to relocate and they have deployed active lobbying toward policy-makers. Their efforts sometimes paid off. But in the post-crisis situation of high political salience, the adversarial mode of state-bank coordination in the UK typically led to loss of otherwise powerful actors (Trumbull 2012; Kastner 2018). British banks couldn’t prevent the implementation of relatively strict banking regulation promoted by most public authorities and supported by the public. Yet, this outcome will certainly not remained unchallenged as the memory of the financial crisis fades away (Culpepper 2010).

Banks’ Embeddedness and Domestic Political Economies

The divergent state priorities towards banks that resulted from the typical policymaking processes described above have had important consequences on banks’ business models and how banking is embedded in national political economies.

French banks have grown considerably since the crisis. To consolidate their position as global players, French banks have benefited from the reinforcement of a quasi-hegemonic position in their domestic retail markets, which has given them stable sources of capital and revenues’ flows. Because the developments of French banks’ position in the global and in the domestic markets go hands in hands, the trajectory of French finance is universalist. The French trajectory of finance may appear, at first sight, to unite the best of the two worlds. French banks are competitive in the global markets. On the other side, at home, proximity banking remains the rule and French banks have preserved their expertise in SME relationship lending. Yet, the French universalist trajectory of finance has darker sides. First, the hegemonic position of French banks allows them to use retail domestic markets as a never-ending source of revenues flows: French banks push their products on quasi captive consumers and they increase fees for retail banking services. Second, French banks are, today more than ever, too big to fail. They will remain a threat on the public budget as long as there is no credible single European resolution fund up and running as an alternative.

Large German commercial banks, especially Deutsche Bank maintained and even expanded its global market activities until 2014-5. Yet, contrary to their French counterparts, German commercial banks have lacked the capital and revenues support of their domestic markets. Indeed, local banks, both cooperative and public, have reinforced their incumbent position in domestic retail markets, including because they have remained protected from competition by law. Because global market finance and domestic retail banking are operated by two different sets of actors, the trajectory of German finance has been bifurcated. There are doubts on the future viability of market-based banking in Germany, as Deutsche Bank may not be able to continue to play its role as a global financial champion. Yet, the fragility of the Bank will continue to pose a threat to the German budget and economy in the foreseeable future. On the other side, although local public and cooperative banks need to address chronically low levels of profitability, German traditional relationship bank-based finance seems back on track – to the satisfaction of domestic SMEs and customers.

British banks have shrunk quite dramatically. They have largely disappeared from the game of global finance and refocused on their domestic retail markets. In parallel, foreign financial institutions have continued to use the infrastructures provided by the City of London as a base for their global market operations. The British trajectory of finance has been offshored. British banks have arguably become smaller, simpler and safer, although the largest of them still count as globally systematically important banks. But British banks have had difficulties to develop traditional bank-based finance, such as simple SMEs lending, because they lack expertise in this area. They have kept investing in niche markets such as credit cards and consumer lending. British small business thus remains confronted to a chronic lack of finance. The government has tried to promote challenger banks with a more traditional locally-rooted business model, but these challenger banks are confronted to structural characteristics of the British economy that are not favorable to banks-based finance, such as low levels of customers’ deposits and savings. The UK economy thus remains to this over-reliant on the City as an offshore financial center.

Conclusion

In the aftermath of the crisis, European governments soon revived with the incentive to promote TBTF banks. Indeed, they perceived the growth of these banks as an essential element of their economy’s global competitiveness. The executive branches of the British, French, and German governments, thus, sought to implement regulation that would not hinder—or even promote—domestic TBTF banks. Yet, typical political institutions have allowed factions—often led by actors from within the state itself—to resist this incentive. The institutional resources that these factions were able to mobilize determined their capacity to carry weight in policymaking processes and eventually shape the different regulatory banking outcomes across Europe. Varieties are important, not just theoretically, but because how states treat their TBTF banks have very concrete consequences for firms and people, as recent studies on TBTF banks’ capital allocation (Erturk and Solari 2007; Dymski 2011; Bazot 2014) , or their role in rising inequalities show (Bell and Reenen 2013; Godechot 2016). That is why International Political Economy and Comparative Political Economy should not be seen as rival, but as complementary approaches to understand a complicatedly governed world.

References

Baumgartner, F.R., Berry, J.M., Hojnacki, M., Leech, B.L. and Kimball, D.C., 2009. Lobbying and policy change: Who wins, who loses, and why. University of Chicago Press.

Bazot, G., 2014. La finance est-elle devenue trop chère? Estimation du coût unitaire d’intermédiation financière en Europe 1951-2007. Notes IPP, (10).

Bell, S. and Hindmoor, A., 2014. The ideational shaping of state power and capacity: Winning battles but losing the war over bank reform in the US and UK. Government and Opposition, 49(3), pp.342-368.

Bell, S. and Hindmoor, A., 2015. Taming the city? Ideas, structural power and the evolution of British banking policy amidst the great financial meltdown. New political economy, 20(3), pp.454-474.

Bell, B.D. and Van Reenen, J., 2013. Extreme wage inequality: pay at the very top. American economic review, 103(3), pp.153-57.

Bourdieu, P., 1989. La noblesse d’État. Grandes écoles et esprit de corps.

Chavagneux, C. and Philipponnat, T., 2014. La capture: où l’on verra comment les intérêts financiers ont pris le pas sur l’intérêt général et comment mettre fin à cette situation. La découverte.

Choulet, C. 2016. “German Sparkassen: A Model to Follow?” BNP-Paribas Conjoncture, 16.

Clemons, E.K. and Weber, B.W., 1990. London’s Big Bang: A Case Study of Information Technology, Competitive Impact, and Organizational Change1. Journal of Management Information Systems, 6(4), pp.41-60.

Clift, B., 2003. The changing political economy of France: Dirigisme under duress. A ruined fortress, pp.173-200.

Coleman, W.D., 1994. Banking, interest intermediation and political power: A framework for comparative analysis. European journal of political research, 26(1), pp.31-58.

Culpepper, P.D., 2010. Quiet politics and business power: Corporate control in Europe and Japan. Cambridge University Press.

Culpepper, P.D., 2015. Structural power and political science in the post-crisis era. Business and Politics, 17(3), pp.391-409.

Dymski, G.A., 2011. The global crisis and the governance of power in finance. In The Financial Crisis (pp. 63-86). Palgrave Macmillan, London.

Emmenegger, P. and Eggenberger, K., 2018. State sovereignty, economic interdependence and US extraterritoriality: The demise of Swiss banking secrecy and the re-embedding of international finance. Journal of international relations and development, 21(3), pp.798-823.

Epstein, R.A., 2017. Banking on markets: the transformation of bank-state ties in Europe and beyond. Oxford University Press.

Epstein, R.A. and Rhodes, M., 2016. The political dynamics behind Europe’s new banking union. West European Politics, 39(3), pp.415-437.

Erturk, I. and Solari, S., 2007. Banks as continuous reinvention. New political economy, 12(3), pp.369-388.

Froud, J., Nilsson, A., Moran, M. and Williams, K., 2012. Stories and Interests in Finance: Agendas of Governance before and after the Financial Crisis. Governance, 25(1), pp.35-59.

Ganderson, J., 2020. To change banks or bankers? Systemic political (in) action and post-crisis banking reform in the UK and the Netherlands. Business and Politics, 22(1), pp.196-223.

Gerschenkron, A., 1962. Economic backwardness in historical perspective: a book of essays (No. 330.947 G381). Cambridge, MA: Belknap Press of Harvard University Press.

Gilligan, G., 1997. The origins of UK financial services regulation. The Company Lawyer, 18(6), pp.167-176.

Godechot, O., 2016. Financialization is marketization! A study of the respective impacts of various dimensions of financialization on the increase in global inequality. Sociological Science, 3, pp.495-519.

Gunlicks, A. 2003. The Länder and German Federalism. Manchester, United Kingdom: Manchester University Press.

Hackethal, A., Schmidt, R.H. and Tyrell, M., 2005. Banks and German corporate governance: on the way to a capital market‐based system?. Corporate Governance: An International Review, 13(3), pp.397-407.

Hall, P.A., Culpepper, P.D. and Palier, B., 2008. Changing France: the politics that markets make.

Hall, P.A. and Soskice, D., 2003. Varieties of capitalism and institutional change: A response to three critics. Comparative European Politics, 1(2), pp.241-250.

Hardie, I. and Howarth, D. eds., 2013. Market-based banking and the international financial crisis. Oxford University Press.

Howarth, D. and Quaglia, L., 2016. The political economy of European banking union. Oxford University Press.

Howarth, D. and Quaglia, L., 2018. The difficult construction of a European Deposit Insurance Scheme: a step too far in Banking Union?. Journal of Economic Policy Reform, 21(3), pp.190-209.

Jabko, N. and Massoc, E., 2012. French capitalism under stress: How Nicolas Sarkozy rescued the banks. Review of International Political Economy, 19(4), pp.562-585.

Kastner, L., 2018. Business lobbying under salience–financial industry mobilization against the European financial transaction tax. Journal of European Public Policy, 25(11), pp.1648-1666.

King, M., 2016. The end of alchemy: Money, banking, and the future of the global economy. WW Norton & Company.

Kwak, James. 2013. “Cultural Capture and the Financial Crisis.” Preventing Regulatory Capture: Special Interest Influence and How to Limit It: 71–98.

Levy, J.D., 1999. Tocqueville’s revenge: state, society, and economy in contemporary France. Harvard University Press.

Levy, J.D., 2008. From the dirigiste state to the social anaesthesia state: French economic policy in the longue durée. Modern & Contemporary France, 16(4), pp.417-435.

Lindblom, Charles E. 1977. Politics and Markets. Basic Books. New York.

Massoc, E. 2017. When Adoption is not Enforcement: The Differentiated Enforcement of Banks’ Capital Ratio Requirements across Europe, Berkeley Journal of Public Policy, (Spring Issue).

Massoc, E., 2020. Banks, power, and political institutions: the divergent priorities of European states towards “too-big-to-fail” banks: The cases of competition in retail banking and the banking structural reform. Business and Politics, 22(1), pp.135-160.

Moschella, M., Pinto, L. and Martocchia Diodati, N., 2020. Let’s speak more? How the ECB responds to public contestation. Journal of European Public Policy, 27(3), pp.400-418.

Rottier, S. and Véron, N., 2010. Not all financial regulation is global. Peterson Institute for International Economics.

Newman, A.L. and Posner, E., 2018. Voluntary disruptions: International soft law, finance, and power. Oxford University Press.

Ostrom, E. 2000. “Collective Action and the Evolution of Social Norms.” Journal of Economic Perspectives 14 (3): 137–58.

Scharpf, F. W. 1988. “The Joint-Decision Trap: Lessons from German Federalism and European Integration.” Public Administration 66 (3): 239–78.

Schoenmaker, D. and Véron, N., 2016. European banking supervision: the first eighteen months. Bruegel Blueprint Series, 25, pp.1-6.

Streeck, W., 2001. High equality, low activity: the contribution of the social welfare system to the stability of the German collective bargaining regime. Industrial and Labour Relations Review, 54(3), pp.698-706.

Thatcher, M., 2007. Regulatory agencies, the state and markets: a Franco-British comparison. Journal of European Public Policy, 14(7), pp.1028-1047.

Trumbull, G., 2012. Strength in numbers: The political power of weak interests. Harvard University Press.

Vogel, D., 2003. Fluctuating fortunes: The political power of business in America. Beard Books.

Woll, C., 2014. The power of inaction: Bank bailouts in comparison. Cornell University Press.

Zysman, J., 1983. Governments, markets, and growth: financial systems and the politics of industrial change. Cornell University Press.

Further Reading on E-International Relations

- Social Media Europe and the Rise of Comedy in Global Diplomacy

- Opinion – The Good, the Bad and the Ugly of COVID-19 Recovery Financing in Europe

- Opinion – Europe is Still Able to Build Tanks

- Opinion – A New Pact on Migration and Asylum in Europe

- Opinion – Europe and China’s Growing Assertiveness

- Opinion – Weakened US Relations Is Pushing Europe Towards China